These Metrics Don't Make China Outfitters Holdings (HKG:1146) Look Too Strong

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. In light of that, from a first glance at China Outfitters Holdings (HKG:1146), we've spotted some signs that it could be struggling, so let's investigate.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for China Outfitters Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.019 = CN¥35m ÷ (CN¥2.1b - CN¥298m) (Based on the trailing twelve months to June 2020).

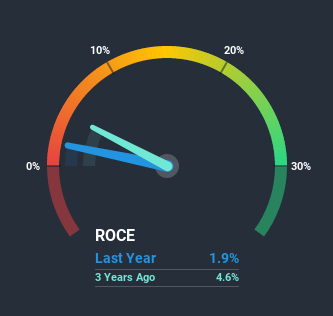

Thus, China Outfitters Holdings has an ROCE of 1.9%. In absolute terms, that's a low return and it also under-performs the Luxury industry average of 9.2%.

View our latest analysis for China Outfitters Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how China Outfitters Holdings has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From China Outfitters Holdings' ROCE Trend?

There is reason to be cautious about China Outfitters Holdings, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 15% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect China Outfitters Holdings to turn into a multi-bagger.

On a side note, China Outfitters Holdings has done well to pay down its current liabilities to 14% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.In Conclusion...

In summary, it's unfortunate that China Outfitters Holdings is generating lower returns from the same amount of capital. We expect this has contributed to the stock plummeting 80% during the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for China Outfitters Holdings (of which 1 is a bit unpleasant!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading China Outfitters Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huicheng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1146

Huicheng International Holdings

An investment holding company, designs, manufactures, markets, and sells apparels and accessories in Mainland China and Taiwan.

Excellent balance sheet low.

Market Insights

Community Narratives