Golden Solar New Energy Technology Holdings Limited's (HKG:1121) 26% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, Golden Solar New Energy Technology Holdings Limited (HKG:1121) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

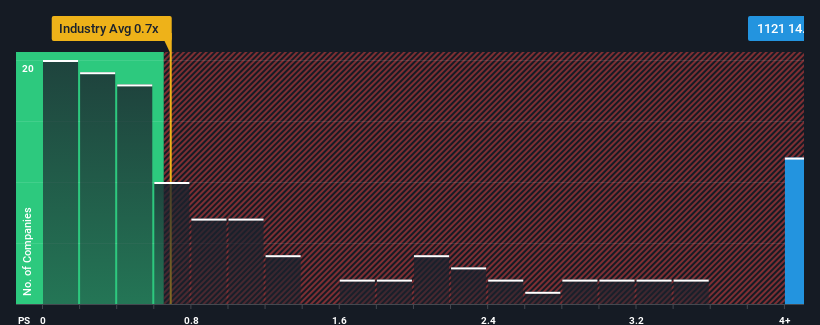

In spite of the heavy fall in price, when almost half of the companies in Hong Kong's Luxury industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Golden Solar New Energy Technology Holdings as a stock not worth researching with its 14.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Golden Solar New Energy Technology Holdings

What Does Golden Solar New Energy Technology Holdings' P/S Mean For Shareholders?

For example, consider that Golden Solar New Energy Technology Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Golden Solar New Energy Technology Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Golden Solar New Energy Technology Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Golden Solar New Energy Technology Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Golden Solar New Energy Technology Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Even after such a strong price drop, Golden Solar New Energy Technology Holdings' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Golden Solar New Energy Technology Holdings revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Golden Solar New Energy Technology Holdings is showing 3 warning signs in our investment analysis, and 2 of those are concerning.

If you're unsure about the strength of Golden Solar New Energy Technology Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1121

Golden Solar New Energy Technology Holdings

An investment holding company, manufactures and sells footwear products in the People’s Republic of China, the United States, South America, Europe, South East Asia, and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives