What Namyue Holdings Limited's (HKG:1058) P/S Is Not Telling You

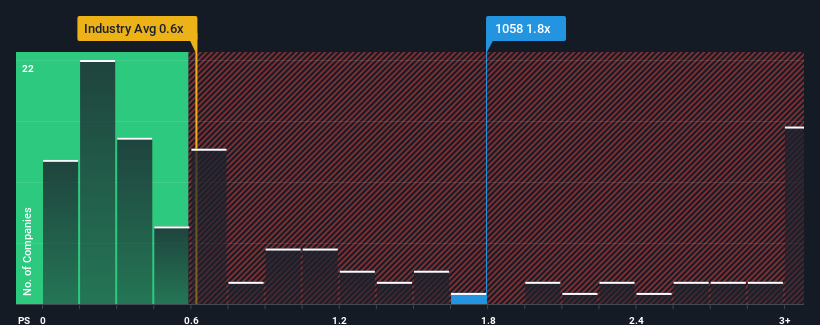

When you see that almost half of the companies in the Luxury industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.6x, Namyue Holdings Limited (HKG:1058) looks to be giving off some sell signals with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Namyue Holdings

How Has Namyue Holdings Performed Recently?

Namyue Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Namyue Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Namyue Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.0%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 66% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Namyue Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Namyue Holdings' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Namyue Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about these 3 warning signs we've spotted with Namyue Holdings (including 2 which are significant).

If these risks are making you reconsider your opinion on Namyue Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Namyue Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1058

Namyue Holdings

An investment holding company, engages in the processing and sale of semi-finished and finished leather in Mainland China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives