Sitoy Group Holdings (HKG:1023) pulls back 15% this week, but still delivers shareholders stellar 100% return over 1 year

Sitoy Group Holdings Limited (HKG:1023) shareholders have seen the share price descend 20% over the month. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 72%.

While the stock has fallen 15% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Sitoy Group Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Sitoy Group Holdings grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We note that the most recent dividend payment is higher than the payment a year ago, so that may have assisted the share price. Income-seeking investors probably helped bid up the stock price. Though we must add that the revenue growth of 11% year on year would have helped paint a pretty picture.

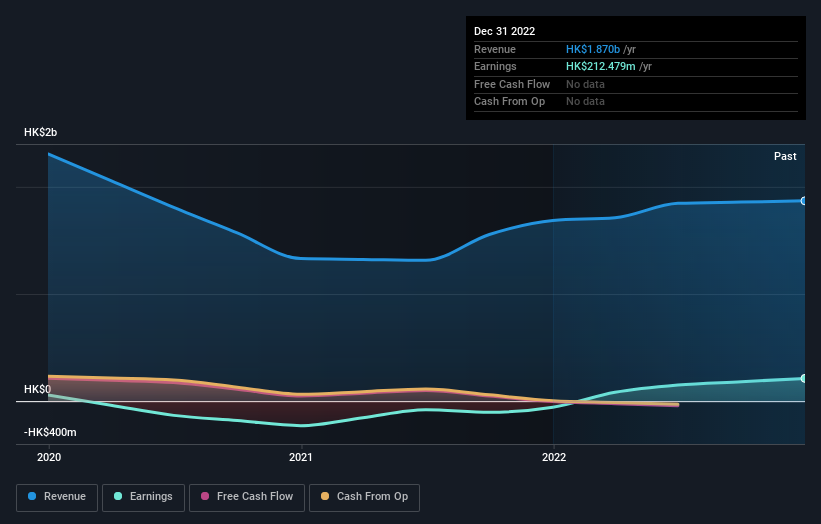

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Sitoy Group Holdings, it has a TSR of 100% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Sitoy Group Holdings shareholders have received a total shareholder return of 100% over one year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Sitoy Group Holdings better, we need to consider many other factors. Even so, be aware that Sitoy Group Holdings is showing 4 warning signs in our investment analysis , and 2 of those are concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1023

Sitoy Group Holdings

Engages in the research, development, design, manufacture, sale, wholesale, and retail of handbags, small leather goods, travel goods, and footwear.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success