Should You Buy Sitoy Group Holdings Limited (HKG:1023) For Its 8.8% Dividend?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is Sitoy Group Holdings Limited (HKG:1023) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

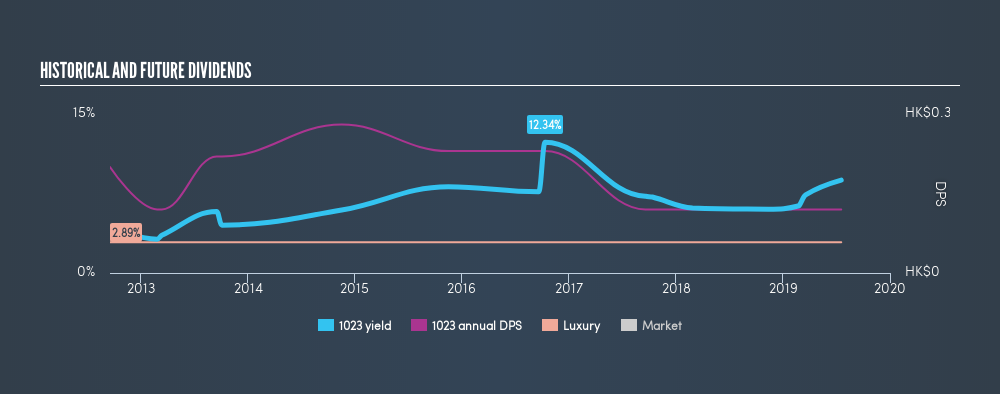

With a seven-year payment history and a 8.8% yield, many investors probably find Sitoy Group Holdings intriguing. We'd agree the yield does look enticing. The company also bought back stock equivalent to around 8.4% of market capitalisation this year. Some simple research can reduce the risk of buying Sitoy Group Holdings for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 52% of Sitoy Group Holdings's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. With a cash payout ratio of 134%, Sitoy Group Holdings's dividend payments are poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. Sitoy Group Holdings paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Cash is king, as they say, and were Sitoy Group Holdings to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that Sitoy Group Holdings has been paying a dividend for the past seven years. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past seven-year period, the first annual payment was HK$0.20 in 2012, compared to HK$0.12 last year. This works out to be a decline of approximately 7.0% per year over that time. Sitoy Group Holdings's dividend has been cut sharply at least once, so it hasn't fallen by 7.0% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either the business or management. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. In the last five years, Sitoy Group Holdings's earnings per share have shrunk at approximately 11% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, the company has a payout ratio that was within an average range for most dividend stocks, but it paid out virtually all of its generated cash flow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. Using these criteria, Sitoy Group Holdings looks quite suboptimal from a dividend investment perspective.

See if management have their own wealth at stake, by checking insider shareholdings in Sitoy Group Holdings stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1023

Sitoy Group Holdings

Engages in the design, research, development, manufacture, sale, wholesale, and retail of handbags, small leather goods, travel goods, and footwear.

Flawless balance sheet and good value.

Market Insights

Community Narratives