As global markets navigate a busy earnings season and mixed economic signals, investors are keenly observing the potential in various market segments. Penny stocks, often associated with smaller or newer companies, continue to capture interest due to their affordability and growth potential. Despite their vintage name, these stocks can offer significant value when they boast strong financials and a clear path for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,773 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components, with a market cap of approximately HK$1.52 billion.

Operations: The company generates revenue primarily from two segments: Mold Fabrication, accounting for HK$767.37 million, and Plastic Components Manufacturing, contributing HK$1.47 billion.

Market Cap: HK$1.52B

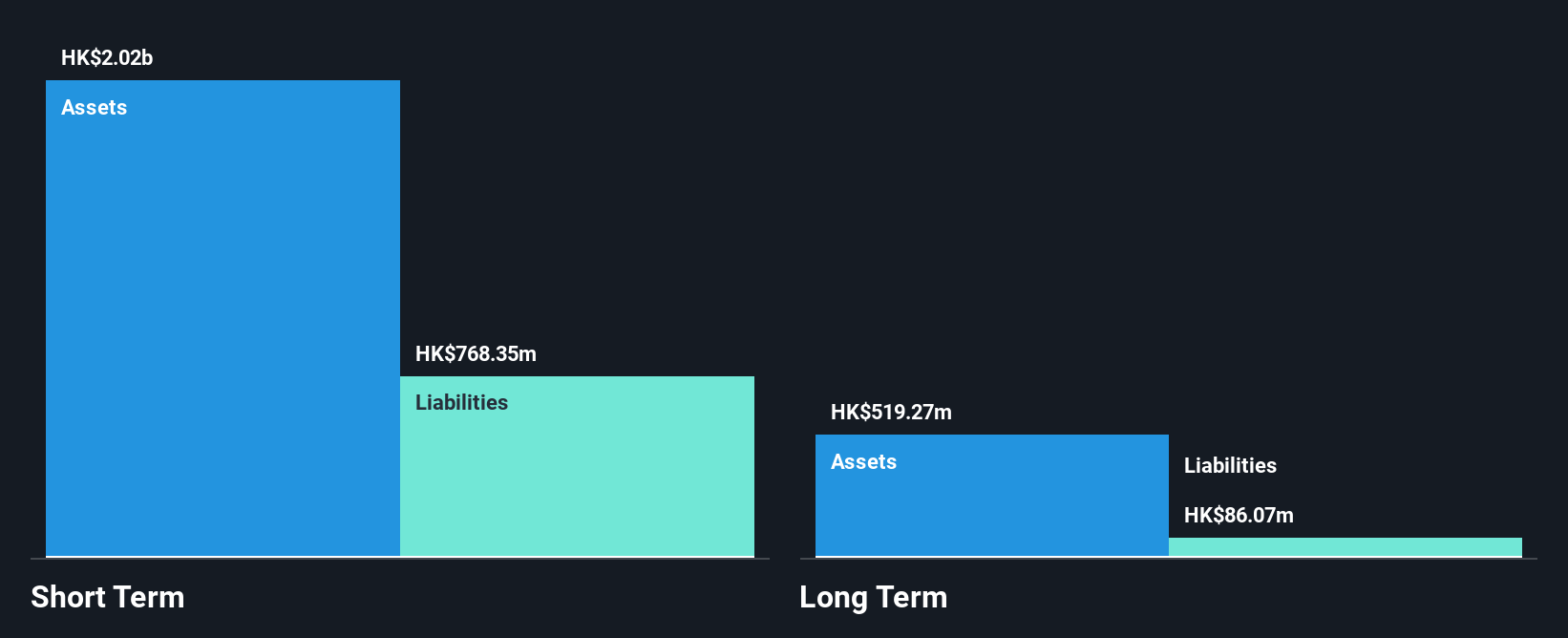

TK Group (Holdings) Limited, with a market cap of HK$1.52 billion, has shown stable financial health and profitability. Its recent earnings report highlighted revenue growth to HK$1.01 billion for the first half of 2024, with net income rising to HK$79.74 million from the previous year. The company declared an interim dividend of HKD 0.04 per share, though its dividend track record is unstable. With no debt and strong short-term assets exceeding liabilities, TK Group maintains a solid balance sheet despite past profit declines over five years. It trades significantly below estimated fair value, suggesting potential undervaluation in the market.

- Click to explore a detailed breakdown of our findings in TK Group (Holdings)'s financial health report.

- Learn about TK Group (Holdings)'s future growth trajectory here.

Chiho Environmental Group (SEHK:976)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chiho Environmental Group Limited is an investment holding company that operates in the metal recycling business across Asia, Europe, and North America, with a market cap of HK$706.27 million.

Operations: The company generates revenue from its operations in Asia and Europe, with Asia contributing HK$1.82 billion and Europe providing HK$14.83 billion.

Market Cap: HK$706.27M

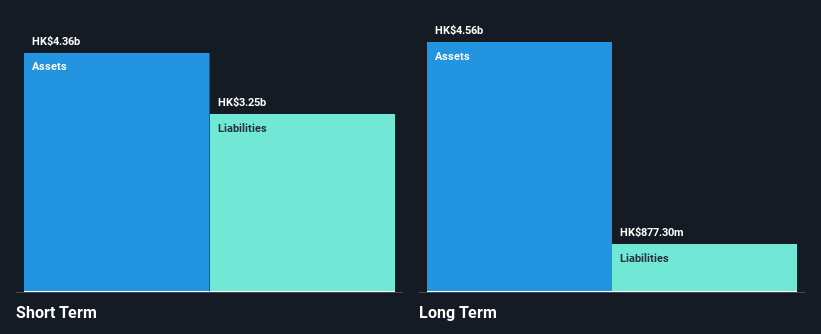

Chiho Environmental Group Limited, with a market cap of HK$706.27 million, operates in the metal recycling industry across Asia and Europe. The company reported sales of HK$8.85 billion for the first half of 2024, showing stable revenue compared to the previous year. Despite being unprofitable, Chiho has reduced its losses over five years and maintains a satisfactory net debt to equity ratio of 13.9%. Short-term assets exceed both short- and long-term liabilities, indicating sound liquidity management. Recent board changes include appointing Ms. Leung Pui Yee as an independent non-executive director to bolster financial oversight with her extensive experience in accounting and finance.

- Jump into the full analysis health report here for a deeper understanding of Chiho Environmental Group.

- Learn about Chiho Environmental Group's historical performance here.

Shanghai Huili Building Materials (SHSE:900939)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Huili Building Materials Co., Ltd. operates in the building materials industry and has a market cap of approximately $112.17 million.

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥15.43 billion.

Market Cap: $112.17M

Shanghai Huili Building Materials Co., Ltd., with a market cap of US$112.17 million, operates debt-free and has recently completed a share buyback program, repurchasing 6.06% of its shares for CN¥16.54 million. Despite having experienced management and board teams, the company faces challenges with declining earnings over five years and recent negative growth of 26.7%. Its net profit margin decreased from 56.7% to 41.2%, while revenues remain modest at CN¥15 million annually, suggesting limited revenue streams in the building materials sector within China amidst high volatility in its share price performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Shanghai Huili Building Materials.

- Examine Shanghai Huili Building Materials' past performance report to understand how it has performed in prior years.

Key Takeaways

- Click here to access our complete index of 5,773 Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TK Group (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2283

TK Group (Holdings)

An investment holding company, engages in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives