- Hong Kong

- /

- Commercial Services

- /

- SEHK:8320

Here's Why I Think Allied Sustainability and Environmental Consultants Group (HKG:8320) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Allied Sustainability and Environmental Consultants Group (HKG:8320). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Allied Sustainability and Environmental Consultants Group

Allied Sustainability and Environmental Consultants Group's Improving Profits

In the last three years Allied Sustainability and Environmental Consultants Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. It's good to see that Allied Sustainability and Environmental Consultants Group's EPS have grown from HK$0.0021 to HK$0.0024 over twelve months. I doubt many would complain about that 14% gain.

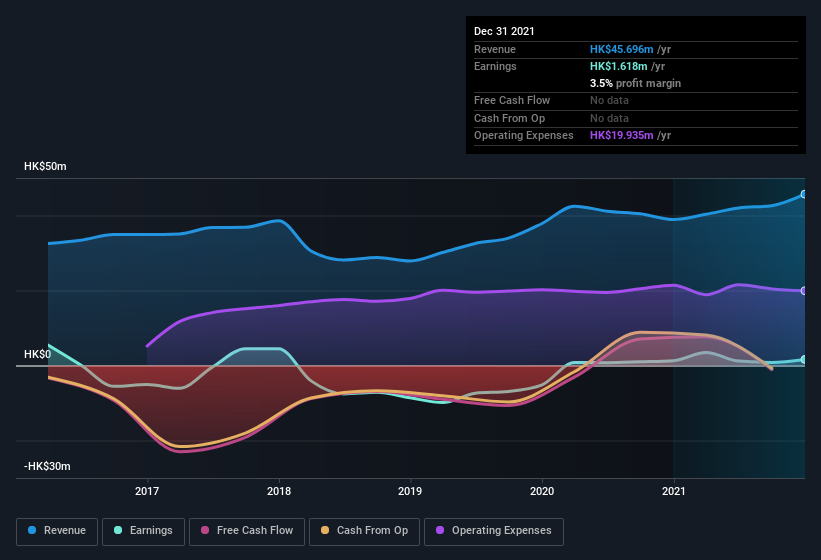

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Allied Sustainability and Environmental Consultants Group shareholders can take confidence from the fact that EBIT margins are up from -2.9% to 5.8%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Allied Sustainability and Environmental Consultants Group is no giant, with a market capitalization of HK$69m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Allied Sustainability and Environmental Consultants Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Allied Sustainability and Environmental Consultants Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Pak kit Wu, the Executive Vice Chairman of the Board of the company, paid HK$82k for shares at around HK$0.14 each.

Should You Add Allied Sustainability and Environmental Consultants Group To Your Watchlist?

One positive for Allied Sustainability and Environmental Consultants Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Allied Sustainability and Environmental Consultants Group seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. You still need to take note of risks, for example - Allied Sustainability and Environmental Consultants Group has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

As a growth investor I do like to see insider buying. But Allied Sustainability and Environmental Consultants Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8320

Allied Sustainability and Environmental Consultants Group

An investment holding company, provides green building and environmental consulting services in Hong Kong, the People’s Republic of China, and Macau.

Excellent balance sheet very low.

Market Insights

Community Narratives