David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Zhongshi Minan Holdings Limited (HKG:8283) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Zhongshi Minan Holdings

How Much Debt Does Zhongshi Minan Holdings Carry?

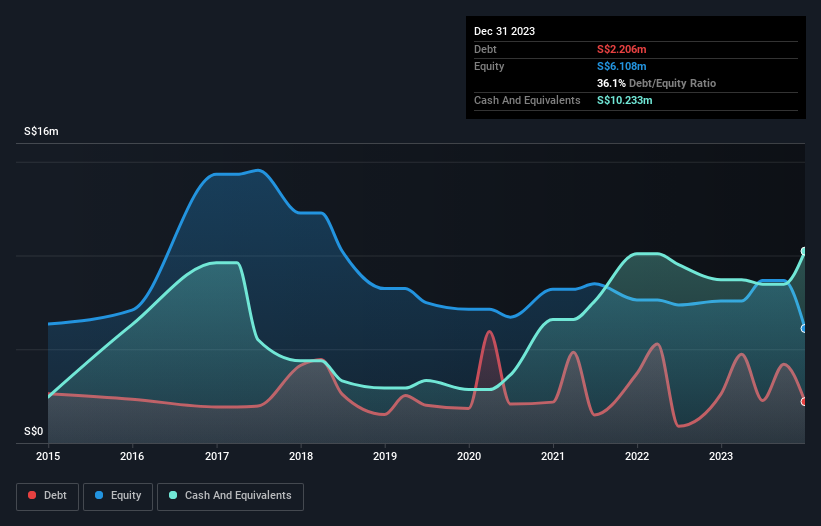

The image below, which you can click on for greater detail, shows that Zhongshi Minan Holdings had debt of S$2.21m at the end of December 2023, a reduction from S$2.61m over a year. However, it does have S$10.2m in cash offsetting this, leading to net cash of S$8.03m.

How Strong Is Zhongshi Minan Holdings' Balance Sheet?

According to the last reported balance sheet, Zhongshi Minan Holdings had liabilities of S$9.03m due within 12 months, and liabilities of S$6.00m due beyond 12 months. On the other hand, it had cash of S$10.2m and S$3.06m worth of receivables due within a year. So its liabilities total S$1.74m more than the combination of its cash and short-term receivables.

Since publicly traded Zhongshi Minan Holdings shares are worth a total of S$39.0m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Zhongshi Minan Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Zhongshi Minan Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Zhongshi Minan Holdings saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is Zhongshi Minan Holdings?

Although Zhongshi Minan Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of S$392k. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Zhongshi Minan Holdings has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Zhongshi Minan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8283

Zhongshi Minan Holdings

An investment holding company, provides passenger car services in Singapore, Mainland China, and other Asia-Pacific countries.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives