- Hong Kong

- /

- Commercial Services

- /

- SEHK:8128

Here's Why We're Watching China Geothermal Industry Development Group's (HKG:8128) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should China Geothermal Industry Development Group (HKG:8128) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for China Geothermal Industry Development Group

When Might China Geothermal Industry Development Group Run Out Of Money?

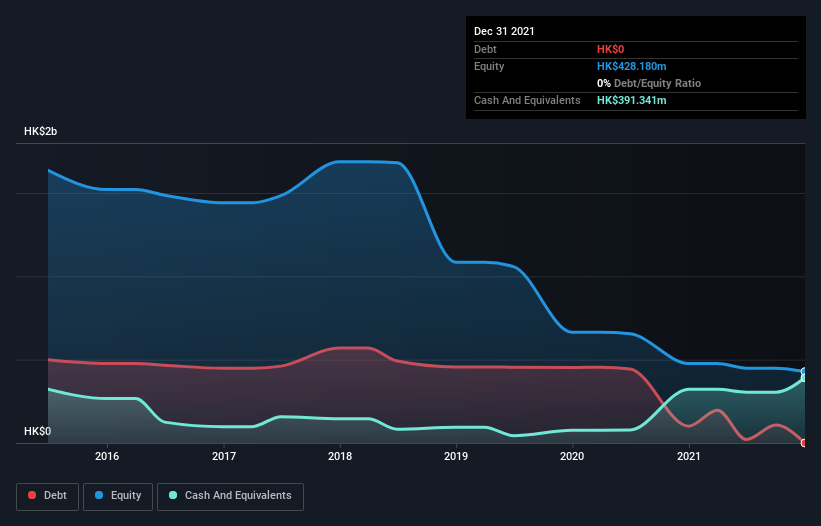

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In December 2021, China Geothermal Industry Development Group had HK$391m in cash, and was debt-free. Looking at the last year, the company burnt through HK$54m. Therefore, from December 2021 it had 7.3 years of cash runway. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Well Is China Geothermal Industry Development Group Growing?

Notably, China Geothermal Industry Development Group actually ramped up its cash burn very hard and fast in the last year, by 117%, signifying heavy investment in the business. While that's concerning on it's own, the fact that operating revenue was actually down 23% over the same period makes us positively tremulous. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how China Geothermal Industry Development Group is building its business over time.

How Easily Can China Geothermal Industry Development Group Raise Cash?

While China Geothermal Industry Development Group seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

China Geothermal Industry Development Group has a market capitalisation of HK$299m and burnt through HK$54m last year, which is 18% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About China Geothermal Industry Development Group's Cash Burn?

On this analysis of China Geothermal Industry Development Group's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, China Geothermal Industry Development Group has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8128

CHYY Development Group

An investment holding company, engages in the research, development, and promotion of geothermal energy as alternative energy for building’s heating applications in the People's Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives