- Hong Kong

- /

- Commercial Services

- /

- SEHK:8128

Does China Geothermal Industry Development Group (HKG:8128) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that China Geothermal Industry Development Group Limited (HKG:8128) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for China Geothermal Industry Development Group

What Is China Geothermal Industry Development Group's Net Debt?

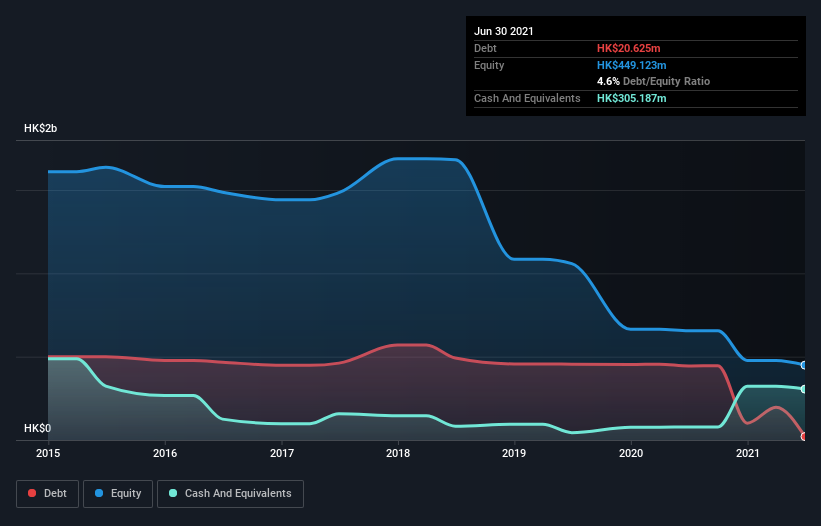

You can click the graphic below for the historical numbers, but it shows that China Geothermal Industry Development Group had HK$20.6m of debt in June 2021, down from HK$443.9m, one year before. However, it does have HK$305.2m in cash offsetting this, leading to net cash of HK$284.6m.

How Healthy Is China Geothermal Industry Development Group's Balance Sheet?

The latest balance sheet data shows that China Geothermal Industry Development Group had liabilities of HK$1.06b due within a year, and liabilities of HK$129.4m falling due after that. Offsetting this, it had HK$305.2m in cash and HK$186.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$697.0m.

The deficiency here weighs heavily on the HK$303.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, China Geothermal Industry Development Group would likely require a major re-capitalisation if it had to pay its creditors today. China Geothermal Industry Development Group boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since China Geothermal Industry Development Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, China Geothermal Industry Development Group made a loss at the EBIT level, and saw its revenue drop to HK$202m, which is a fall of 44%. That makes us nervous, to say the least.

So How Risky Is China Geothermal Industry Development Group?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year China Geothermal Industry Development Group had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of HK$73m and booked a HK$279m accounting loss. However, it has net cash of HK$284.6m, so it has a bit of time before it will need more capital. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for China Geothermal Industry Development Group (of which 1 shouldn't be ignored!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8128

CHYY Development Group

An investment holding company, engages in the research, development, and promotion of geothermal energy as alternative energy for building’s heating applications in the People's Republic of China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives