The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, KPM Holding Limited (HKG:8027) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for KPM Holding

What Is KPM Holding's Debt?

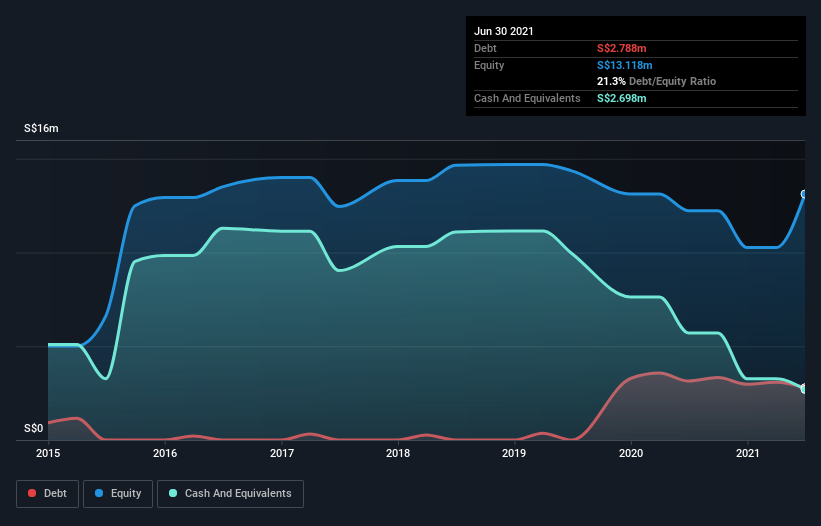

As you can see below, KPM Holding had S$2.79m of debt at June 2021, down from S$3.14m a year prior. However, it does have S$2.70m in cash offsetting this, leading to net debt of about S$90.0k.

How Healthy Is KPM Holding's Balance Sheet?

The latest balance sheet data shows that KPM Holding had liabilities of S$1.90m due within a year, and liabilities of S$2.47m falling due after that. Offsetting this, it had S$2.70m in cash and S$7.48m in receivables that were due within 12 months. So it actually has S$5.80m more liquid assets than total liabilities.

This excess liquidity suggests that KPM Holding is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Carrying virtually no net debt, KPM Holding has a very light debt load indeed. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since KPM Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year KPM Holding wasn't profitable at an EBIT level, but managed to grow its revenue by 72%, to S$12m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly appreciate KPM Holding's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at S$1.3m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for KPM Holding you should be aware of, and 3 of them are potentially serious.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade KPM Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPM Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8027

KPM Holding

An investment holding company, engages in the design, fabrication, installation, and maintenance of signage and related products in Singapore and the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives