- Hong Kong

- /

- Professional Services

- /

- SEHK:6919

Renrui Human Resources Technology Holdings (HKG:6919) Is Experiencing Growth In Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Renrui Human Resources Technology Holdings' (HKG:6919) returns on capital, so let's have a look.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Renrui Human Resources Technology Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.014 = CN¥18m ÷ (CN¥1.7b - CN¥416m) (Based on the trailing twelve months to June 2022).

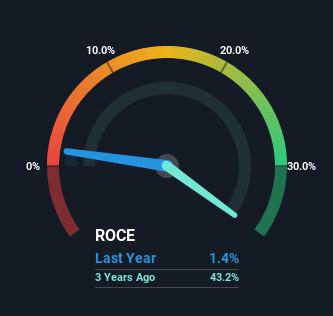

So, Renrui Human Resources Technology Holdings has an ROCE of 1.4%. Ultimately, that's a low return and it under-performs the Professional Services industry average of 11%.

Check out the opportunities and risks within the HK Professional Services industry.

In the above chart we have measured Renrui Human Resources Technology Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Renrui Human Resources Technology Holdings.

What Does the ROCE Trend For Renrui Human Resources Technology Holdings Tell Us?

We're delighted to see that Renrui Human Resources Technology Holdings is reaping rewards from its investments and is now generating some pre-tax profits. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 1.4% on its capital. In addition to that, Renrui Human Resources Technology Holdings is employing 3,251% more capital than previously which is expected of a company that's trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a related note, the company's ratio of current liabilities to total assets has decreased to 25%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So this improvement in ROCE has come from the business' underlying economics, which is great to see.

The Bottom Line

Overall, Renrui Human Resources Technology Holdings gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. And since the stock has fallen 46% over the last year, there might be an opportunity here. So researching this company further and determining whether or not these trends will continue seems justified.

On a final note, we found 4 warning signs for Renrui Human Resources Technology Holdings (1 is concerning) you should be aware of.

While Renrui Human Resources Technology Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6919

Renrui Human Resources Technology Holdings

An investment holding company, provides human resources services in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives