- Hong Kong

- /

- Commercial Services

- /

- SEHK:6677

Sino-Ocean Service Holding Limited (HKG:6677) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Sino-Ocean Service Holding Limited (HKG:6677) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

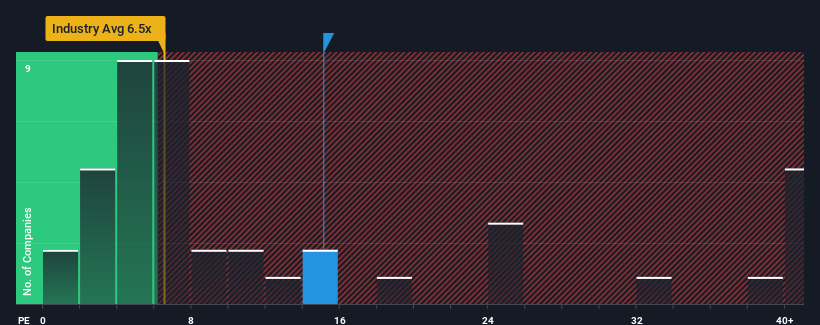

Since its price has surged higher, Sino-Ocean Service Holding may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 15.1x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Sino-Ocean Service Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Sino-Ocean Service Holding

Is There Enough Growth For Sino-Ocean Service Holding?

Sino-Ocean Service Holding's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. As a result, earnings from three years ago have also fallen 88% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 56% each year as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 16% each year growth forecast for the broader market.

With this information, we can see why Sino-Ocean Service Holding is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Sino-Ocean Service Holding's P/E?

Sino-Ocean Service Holding's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sino-Ocean Service Holding maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Sino-Ocean Service Holding you should know about.

Of course, you might also be able to find a better stock than Sino-Ocean Service Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6677

Sino-Ocean Service Holding

An investment holding company, primarily engages in the provision of property management, and commercial operational and value-added services in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives