- Hong Kong

- /

- Professional Services

- /

- SEHK:6128

Some Confidence Is Lacking In Graphex Group Limited (HKG:6128) As Shares Slide 28%

Unfortunately for some shareholders, the Graphex Group Limited (HKG:6128) share price has dived 28% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

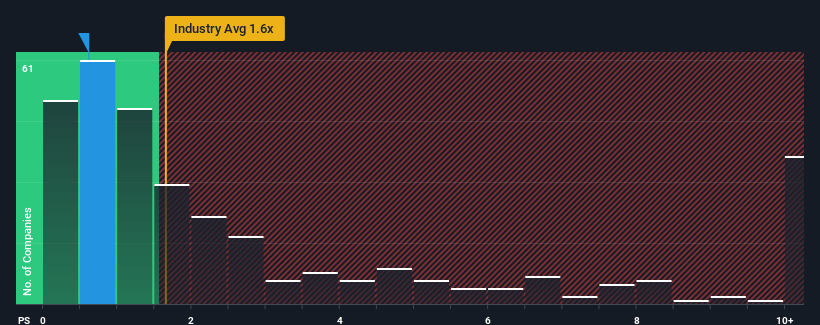

Although its price has dipped substantially, there still wouldn't be many who think Graphex Group's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Hong Kong's Professional Services industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Graphex Group

What Does Graphex Group's P/S Mean For Shareholders?

The recently shrinking revenue for Graphex Group has been in line with the industry. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Graphex Group will help you uncover what's on the horizon.How Is Graphex Group's Revenue Growth Trending?

Graphex Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. As a result, revenue from three years ago have also fallen 13% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 2.8% as estimated by the sole analyst watching the company. With the industry predicted to deliver 9.2% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Graphex Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Graphex Group's P/S

With its share price dropping off a cliff, the P/S for Graphex Group looks to be in line with the rest of the Professional Services industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Graphex Group's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 3 warning signs for Graphex Group you should be aware of, and 1 of them is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6128

Graphex Group

Engages in the processing and sale of graphite and graphene products in Mainland China, Hong Kong, and internationally.

Slight and fair value.

Market Insights

Community Narratives