- Hong Kong

- /

- Professional Services

- /

- SEHK:6113

We Think That There Are Issues Underlying UTS Marketing Solutions Holdings' (HKG:6113) Earnings

Despite posting some strong earnings, the market for UTS Marketing Solutions Holdings Limited's (HKG:6113) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

Check out our latest analysis for UTS Marketing Solutions Holdings

A Closer Look At UTS Marketing Solutions Holdings' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

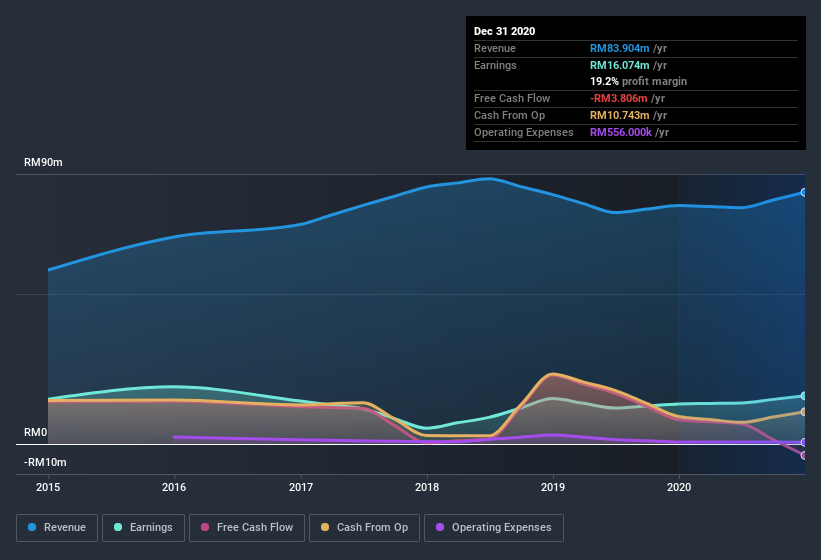

For the year to December 2020, UTS Marketing Solutions Holdings had an accrual ratio of 0.35. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Over the last year it actually had negative free cash flow of RM3.8m, in contrast to the aforementioned profit of RM16.1m. We saw that FCF was RM8.1m a year ago though, so UTS Marketing Solutions Holdings has at least been able to generate positive FCF in the past.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of UTS Marketing Solutions Holdings.

Our Take On UTS Marketing Solutions Holdings' Profit Performance

As we discussed above, we think UTS Marketing Solutions Holdings' earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that UTS Marketing Solutions Holdings' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about UTS Marketing Solutions Holdings as a business, it's important to be aware of any risks it's facing. To help with this, we've discovered 3 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in UTS Marketing Solutions Holdings.

Today we've zoomed in on a single data point to better understand the nature of UTS Marketing Solutions Holdings' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade UTS Marketing Solutions Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BitStrat Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6113

BitStrat Holdings

An investment holding company, provides outbound telemarketing services and contact center facilities in Malaysia.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives