- Hong Kong

- /

- Commercial Services

- /

- SEHK:3321

Wai Hung Group Holdings (HKG:3321) Shareholders Have Enjoyed A Whopping 438% Share Price Gain

While Wai Hung Group Holdings Limited (HKG:3321) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 18% in the last quarter. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 438% rise, throughout the period. So we wouldn't blame sellers for taking some profits. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

View our latest analysis for Wai Hung Group Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Wai Hung Group Holdings actually saw its earnings per share drop 76%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Wai Hung Group Holdings' revenue actually dropped 33% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

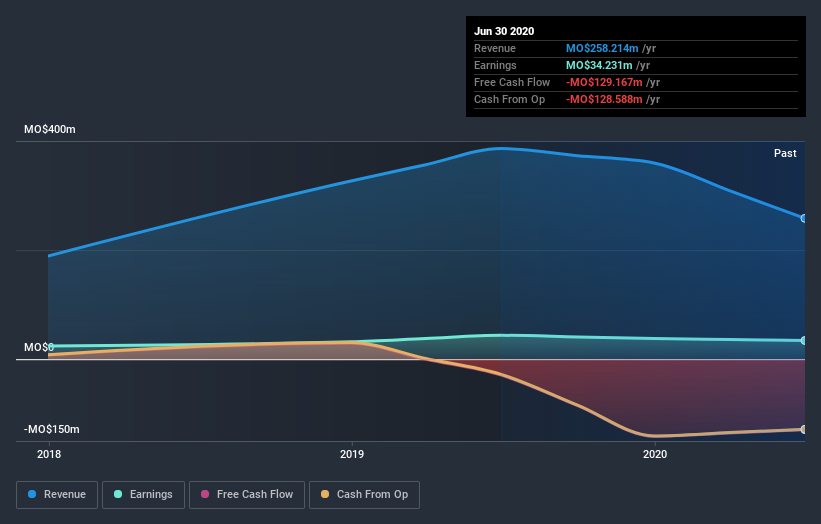

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Wai Hung Group Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Wai Hung Group Holdings shareholders have gained 438% over the last year. We regret to report that the share price is down 18% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Wai Hung Group Holdings better, we need to consider many other factors. For example, we've discovered 3 warning signs for Wai Hung Group Holdings (1 can't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Wai Hung Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wai Hung Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3321

Wai Hung Group Holdings

An investment holding company, operates as a contractor providing fitting-out services, and repair and maintenance services in Macau and Hong Kong.

Medium-low and slightly overvalued.

Market Insights

Community Narratives