- Hong Kong

- /

- Commercial Services

- /

- SEHK:3321

Some Wai Hung Group Holdings Limited (HKG:3321) Shareholders Look For Exit As Shares Take 31% Pounding

Unfortunately for some shareholders, the Wai Hung Group Holdings Limited (HKG:3321) share price has dived 31% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

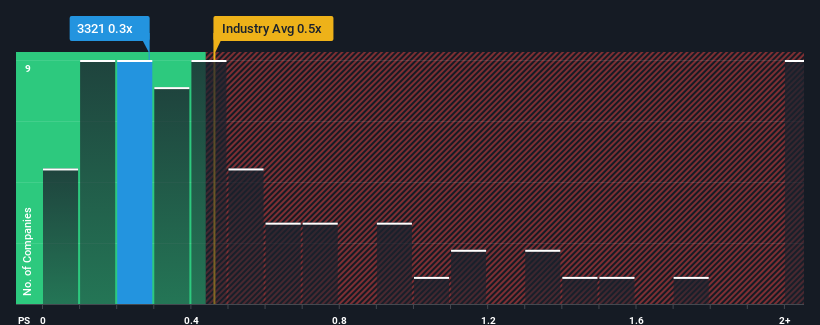

Although its price has dipped substantially, there still wouldn't be many who think Wai Hung Group Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Commercial Services industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Wai Hung Group Holdings

What Does Wai Hung Group Holdings' P/S Mean For Shareholders?

Wai Hung Group Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wai Hung Group Holdings will help you shine a light on its historical performance.How Is Wai Hung Group Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Wai Hung Group Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 94% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 79% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 9.1% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Wai Hung Group Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Wai Hung Group Holdings' P/S

Following Wai Hung Group Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Wai Hung Group Holdings trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Wai Hung Group Holdings (of which 4 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wai Hung Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3321

Wai Hung Group Holdings

An investment holding company, operates as a contractor providing fitting-out services, and repair and maintenance services in Macau and Hong Kong.

Medium-low and slightly overvalued.

Market Insights

Community Narratives