- Hong Kong

- /

- Real Estate

- /

- SEHK:3319

If You Like EPS Growth Then Check Out A-Living Smart City Services (HKG:3319) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like A-Living Smart City Services (HKG:3319). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for A-Living Smart City Services

A-Living Smart City Services's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Who among us would not applaud A-Living Smart City Services's stratospheric annual EPS growth of 56%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

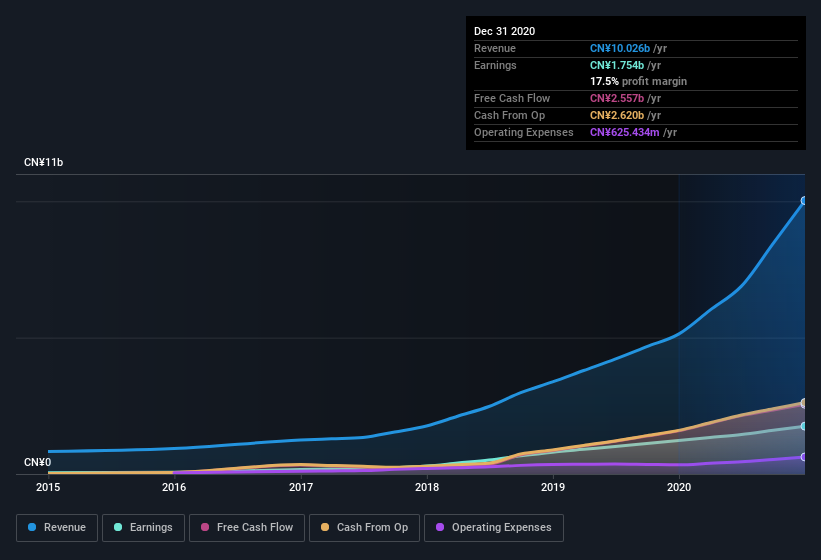

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While A-Living Smart City Services did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for A-Living Smart City Services.

Are A-Living Smart City Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for A-Living Smart City Services, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, the President, Dalong Li, accumulated CN¥6.5m worth of shares around CN¥32.36. It doesn't get much better than that, in terms of large investments from insiders.

I do like that insiders have been buying shares in A-Living Smart City Services, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like A-Living Smart City Services with market caps between CN¥26b and CN¥77b is about CN¥3.4m.

The A-Living Smart City Services CEO received CN¥3.0m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is A-Living Smart City Services Worth Keeping An Eye On?

A-Living Smart City Services's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that A-Living Smart City Services is at an inflection point, given the EPS growth. If so, then it the potential for further gains probably merit a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for A-Living Smart City Services that you should be aware of.

As a growth investor I do like to see insider buying. But A-Living Smart City Services isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3319

A-Living Smart City Services

Provides property management, sale, and inspection services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives