- Hong Kong

- /

- Commercial Services

- /

- SEHK:257

If EPS Growth Is Important To You, China Everbright Environment Group (HKG:257) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China Everbright Environment Group (HKG:257). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for China Everbright Environment Group

How Quickly Is China Everbright Environment Group Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, China Everbright Environment Group has grown EPS by 8.9% per year. That's a pretty good rate, if the company can sustain it.

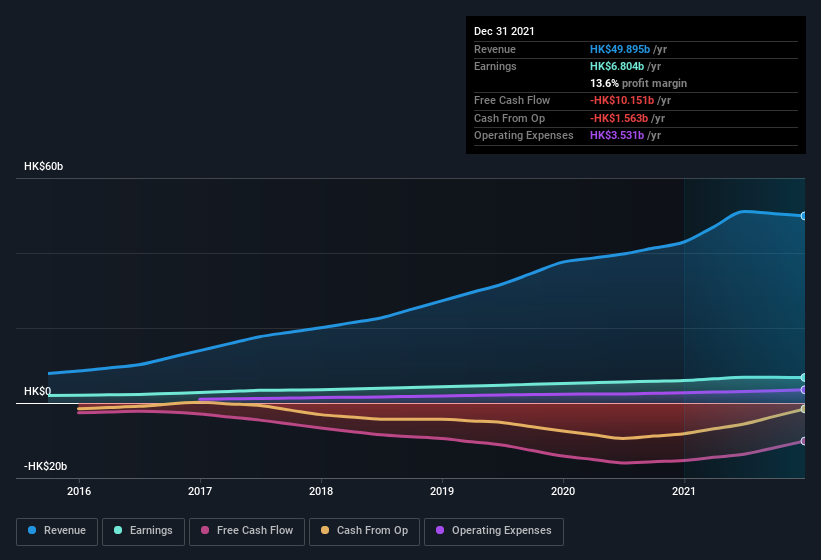

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. China Everbright Environment Group maintained stable EBIT margins over the last year, all while growing revenue 16% to HK$50b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for China Everbright Environment Group's future EPS 100% free.

Are China Everbright Environment Group Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between HK$16b and HK$50b, like China Everbright Environment Group, the median CEO pay is around HK$3.5m.

China Everbright Environment Group offered total compensation worth HK$2.3m to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is China Everbright Environment Group Worth Keeping An Eye On?

One positive for China Everbright Environment Group is that it is growing EPS. That's nice to see. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So based on its merits, the stock deserves further research, if not an addition to your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for China Everbright Environment Group (of which 1 shouldn't be ignored!) you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:257

China Everbright Environment Group

An investment holding company, provides environmental solutions worldwide.

Average dividend payer and fair value.

Market Insights

Community Narratives