- Hong Kong

- /

- Commercial Services

- /

- SEHK:257

Evaluating China Everbright Environment Group (SEHK:257) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Price-to-Earnings of 9.2x: Is it justified?

China Everbright Environment Group is currently trading at a Price-to-Earnings (P/E) ratio of 9.2, which is well below both its peer average of 31.8 and the Hong Kong Commercial Services industry average of 10.2. This suggests that the stock appears undervalued relative to its sector and industry benchmarks.

The P/E ratio is a widely used metric that measures a company's current share price relative to its per-share earnings. For businesses in the commercial services sector, this multiple helps investors gauge how much they are paying for a piece of the company's earnings compared to other available investments.

Given the lower-than-average P/E, it indicates the market may be underestimating the company’s potential profitability or future growth prospects, especially when compared to industry peers. The valuation could reflect concerns about some operational challenges. It also presents an opportunity for investors who believe the company will outperform current expectations.

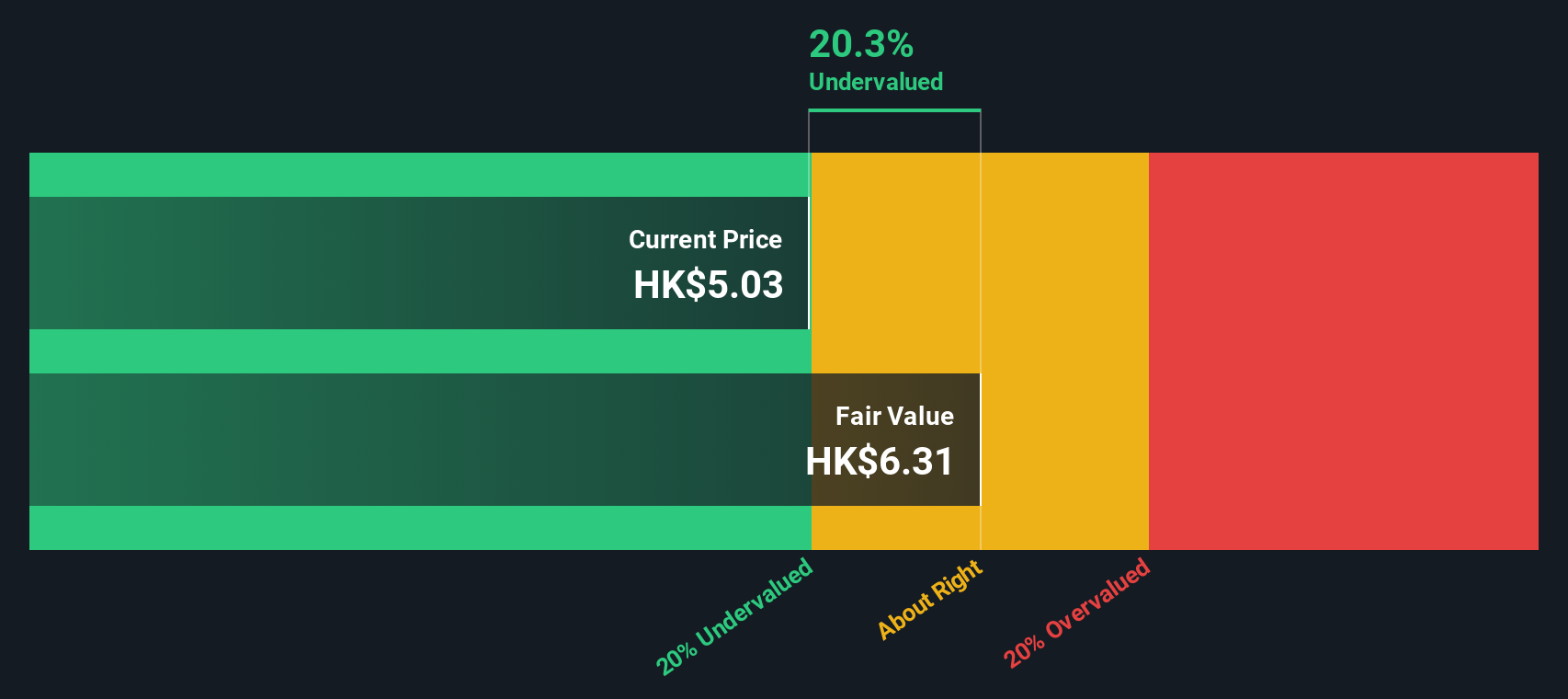

Result: Fair Value of $5.11 (UNDERVALUED)

See our latest analysis for China Everbright Environment Group.However, slower revenue growth and uncertainty around future profitability remain risks that could challenge the market’s optimistic view on the company.

Find out about the key risks to this China Everbright Environment Group narrative.Another View: SWS DCF Model Offers a Second Opinion

Taking a step back from the earnings ratio, our DCF model looks at China Everbright Environment Group by estimating future cash flows. This approach suggests the stock is also undervalued. However, can a cash flow forecast really capture all market risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own China Everbright Environment Group Narrative

If our take does not align with your view, or you enjoy conducting your own analysis, you can construct your own in just a few minutes. Do it your way.

A great starting point for your China Everbright Environment Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just stop at one opportunity. Expand your research and get ahead of the market by targeting stocks making waves in other innovative sectors.

- Boost your income potential by tapping into companies delivering strong payouts with dividend stocks with yields > 3% and uncover those consistent performers yielding over 3%.

- Capture cutting-edge growth by scanning leading players at the cross-section of medicine and AI through healthcare AI stocks to see who is transforming healthcare.

- Seize timely value by starting your search using undervalued stocks based on cash flows to pinpoint stocks priced below their true worth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:257

China Everbright Environment Group

An investment holding company, provides environmental solutions worldwide.

Good value average dividend payer.

Market Insights

Community Narratives