- Hong Kong

- /

- Commercial Services

- /

- SEHK:2377

There's No Escaping China Boqi Environmental (Holding) Co., Ltd.'s (HKG:2377) Muted Earnings Despite A 34% Share Price Rise

China Boqi Environmental (Holding) Co., Ltd. (HKG:2377) shares have continued their recent momentum with a 34% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 75% in the last year.

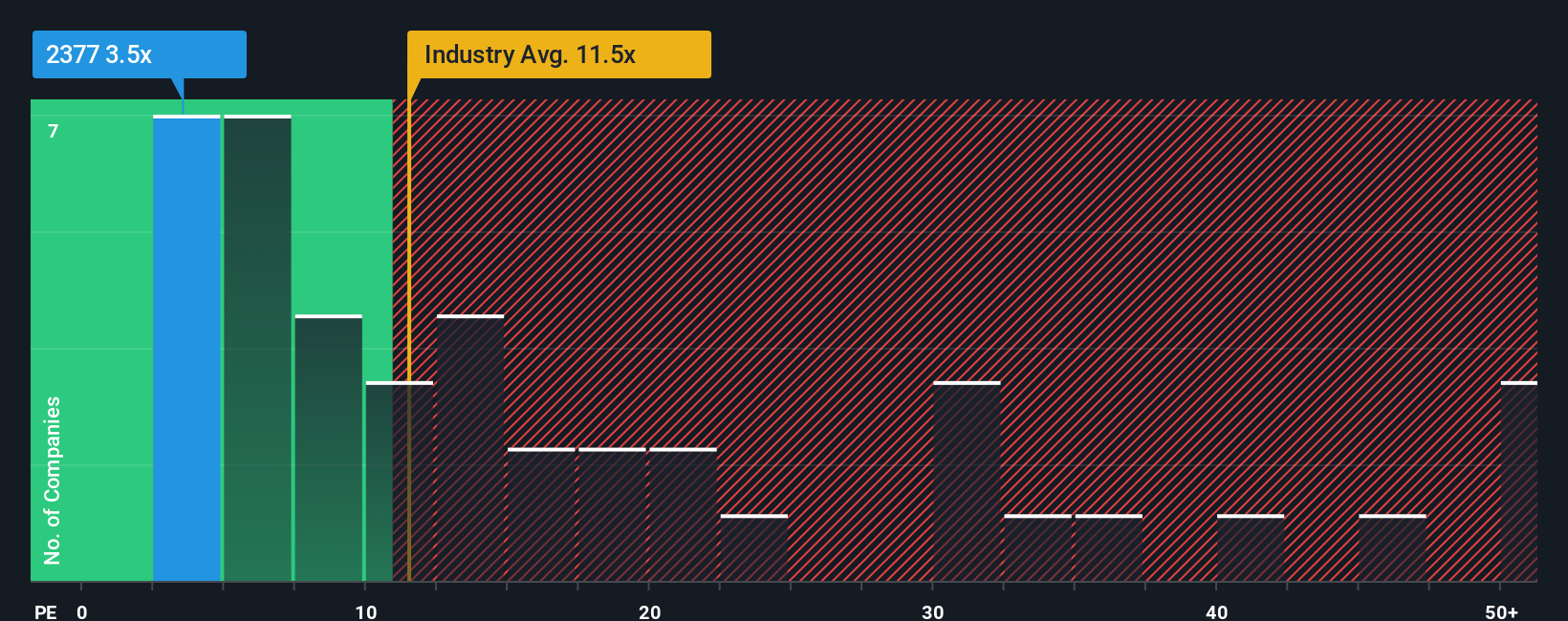

Even after such a large jump in price, China Boqi Environmental (Holding)'s price-to-earnings (or "P/E") ratio of 3.5x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 28x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

China Boqi Environmental (Holding) has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for China Boqi Environmental (Holding)

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Boqi Environmental (Holding)'s to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow EPS by 64% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that China Boqi Environmental (Holding)'s P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

China Boqi Environmental (Holding)'s recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Boqi Environmental (Holding) maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China Boqi Environmental (Holding) that you need to be mindful of.

If these risks are making you reconsider your opinion on China Boqi Environmental (Holding), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2377

China Boqi Environmental (Holding)

An investment holding company, provides flue gas treatment services and environmental protection solutions in the People's Republic of China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives