- Hong Kong

- /

- Professional Services

- /

- SEHK:2180

ManpowerGroup Greater China's (HKG:2180) earnings have declined over five years, contributing to shareholders 33% loss

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in ManpowerGroup Greater China Limited (HKG:2180), since the last five years saw the share price fall 54%.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for ManpowerGroup Greater China

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

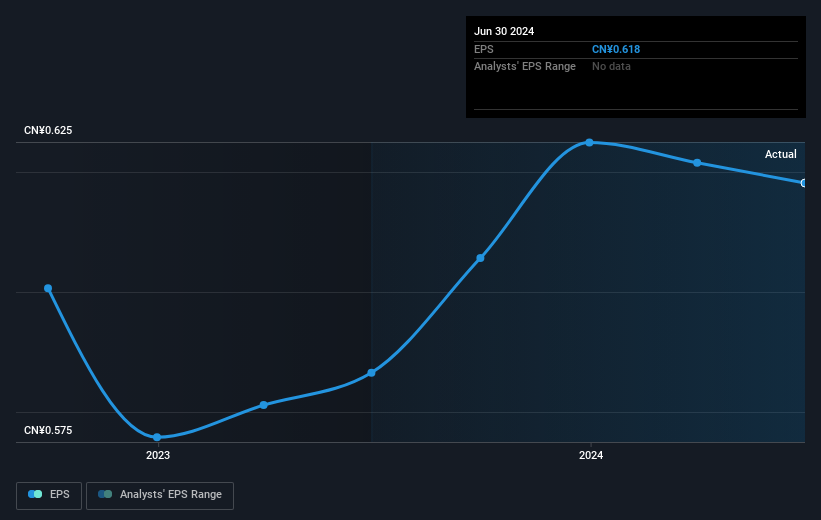

During the five years over which the share price declined, ManpowerGroup Greater China's earnings per share (EPS) dropped by 0.2% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 15% per year, over the period. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 7.43.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into ManpowerGroup Greater China's key metrics by checking this interactive graph of ManpowerGroup Greater China's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of ManpowerGroup Greater China, it has a TSR of -33% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

ManpowerGroup Greater China provided a TSR of 5.8% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for ManpowerGroup Greater China you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2180

ManpowerGroup Greater China

An investment holding company, provides workforce solutions and services in the People’s Republic of China, Hong Kong, Macau, and Taiwan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives