- Hong Kong

- /

- Commercial Services

- /

- SEHK:1884

eprint Group Limited (HKG:1884) Stocks Pounded By 37% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, eprint Group Limited (HKG:1884) shares are down a considerable 37% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

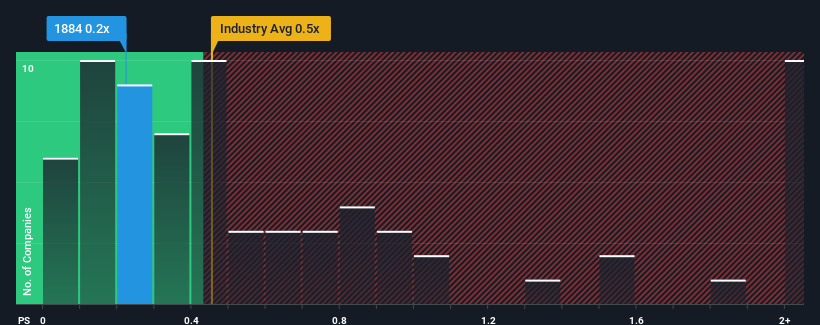

In spite of the heavy fall in price, there still wouldn't be many who think eprint Group's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Commercial Services industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for eprint Group

What Does eprint Group's P/S Mean For Shareholders?

It looks like revenue growth has deserted eprint Group recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on eprint Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like eprint Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 18% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 7.3% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that eprint Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Following eprint Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that eprint Group maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for eprint Group you should know about.

If these risks are making you reconsider your opinion on eprint Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade eprint Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1884

eprint Group

An investment holding company, provides printing services and solutions on advertisements, bound books, and stationeries in Hong Kong.

Excellent balance sheet and good value.

Market Insights

Community Narratives