- Hong Kong

- /

- Commercial Services

- /

- SEHK:1845

Weigang Environmental Technology Holding Group (HKG:1845) Seems To Use Debt Rather Sparingly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Weigang Environmental Technology Holding Group Limited (HKG:1845) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Weigang Environmental Technology Holding Group

What Is Weigang Environmental Technology Holding Group's Debt?

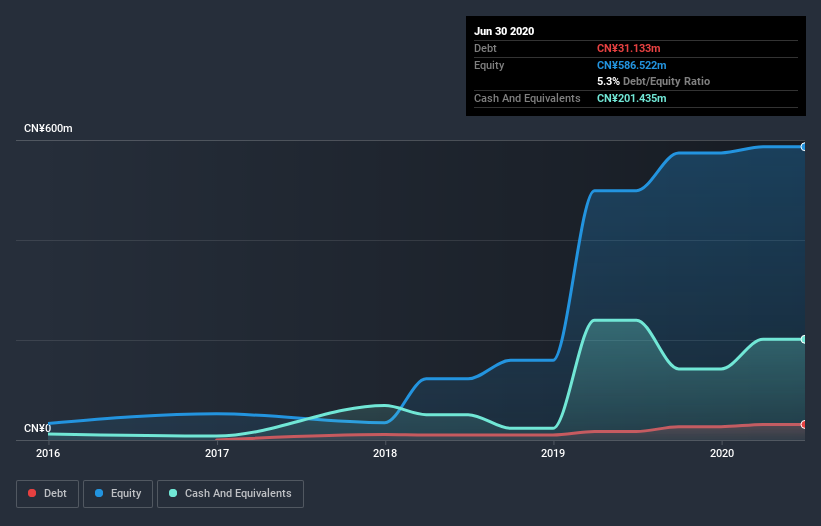

As you can see below, at the end of June 2020, Weigang Environmental Technology Holding Group had CN¥31.1m of debt, up from CN¥16.9m a year ago. Click the image for more detail. However, its balance sheet shows it holds CN¥201.4m in cash, so it actually has CN¥170.3m net cash.

A Look At Weigang Environmental Technology Holding Group's Liabilities

We can see from the most recent balance sheet that Weigang Environmental Technology Holding Group had liabilities of CN¥252.6m falling due within a year, and liabilities of CN¥6.04m due beyond that. Offsetting these obligations, it had cash of CN¥201.4m as well as receivables valued at CN¥401.0m due within 12 months. So it can boast CN¥343.8m more liquid assets than total liabilities.

This surplus strongly suggests that Weigang Environmental Technology Holding Group has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Weigang Environmental Technology Holding Group boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Weigang Environmental Technology Holding Group grew its EBIT by 16% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is Weigang Environmental Technology Holding Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Weigang Environmental Technology Holding Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Weigang Environmental Technology Holding Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Weigang Environmental Technology Holding Group has CN¥170.3m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 16% over the last year. So is Weigang Environmental Technology Holding Group's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Weigang Environmental Technology Holding Group (including 1 which is is potentially serious) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Weigang Environmental Technology Holding Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Weigang Environmental Technology Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1845

Weigang Environmental Technology Holding Group

Engages in the research, design, integration, and commissioning solid waste treatment systems primarily for hazardous waste incineration in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives