- Hong Kong

- /

- Commercial Services

- /

- SEHK:1845

Have Insiders Been Selling Weigang Environmental Technology Holding Group Limited (HKG:1845) Shares This Year?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Weigang Environmental Technology Holding Group Limited (HKG:1845), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Weigang Environmental Technology Holding Group

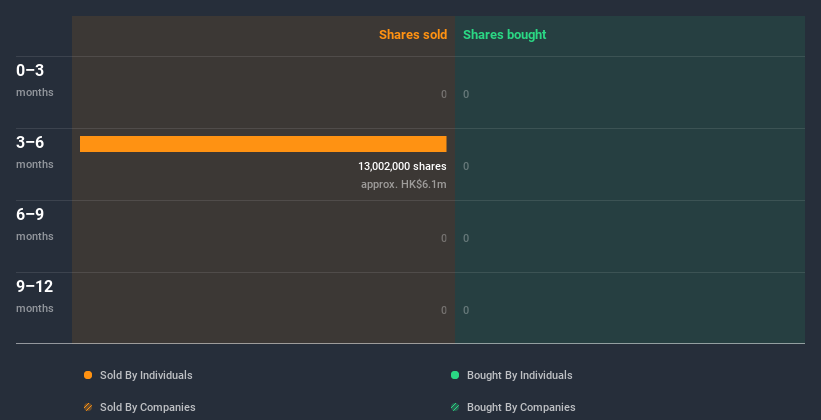

The Last 12 Months Of Insider Transactions At Weigang Environmental Technology Holding Group

In the last twelve months, the biggest single sale by an insider was when the Executive Chairman & CEO, Zhuhua Cai, sold HK$6.1m worth of shares at a price of HK$0.47 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The silver lining is that this sell-down took place above the latest price (HK$0.34). So it may not shed much light on insider confidence at current levels. The only individual insider seller over the last year was Zhuhua Cai.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Weigang Environmental Technology Holding Group Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Weigang Environmental Technology Holding Group insiders own 68% of the company, currently worth about HK$298m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Weigang Environmental Technology Holding Group Insiders?

The fact that there have been no Weigang Environmental Technology Holding Group insider transactions recently certainly doesn't bother us. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Weigang Environmental Technology Holding Group insiders selling. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Be aware that Weigang Environmental Technology Holding Group is showing 3 warning signs in our investment analysis, and 1 of those is significant...

But note: Weigang Environmental Technology Holding Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Weigang Environmental Technology Holding Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Weigang Environmental Technology Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1845

Weigang Environmental Technology Holding Group

Engages in the research, design, integration, and commissioning solid waste treatment systems primarily for hazardous waste incineration in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)