- Hong Kong

- /

- Commercial Services

- /

- SEHK:1540

Left Field Printing Group Limited (HKG:1540) Stock's On A Decline: Are Poor Fundamentals The Cause?

Left Field Printing Group (HKG:1540) has had a rough three months with its share price down 8.7%. Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. Particularly, we will be paying attention to Left Field Printing Group's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Left Field Printing Group

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Left Field Printing Group is:

9.5% = HK$23m ÷ HK$246m (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.10 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Left Field Printing Group's Earnings Growth And 9.5% ROE

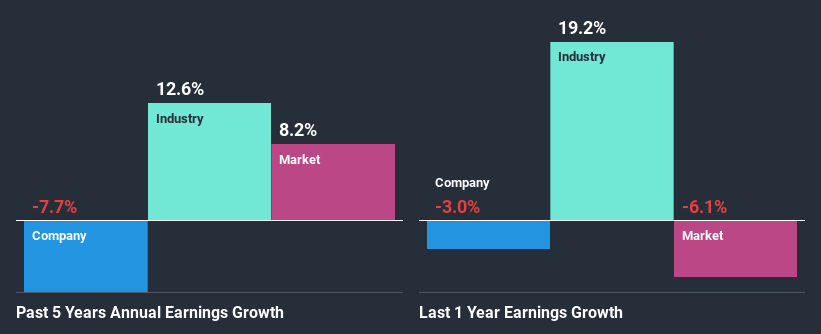

At first glance, Left Field Printing Group's ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 9.8%, we may spare it some thought. But then again, Left Field Printing Group's five year net income shrunk at a rate of 7.7%. Bear in mind, the company does have a slightly low ROE. So that's what might be causing earnings growth to shrink.

That being said, we compared Left Field Printing Group's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 13% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Left Field Printing Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Left Field Printing Group Making Efficient Use Of Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Left Field Printing Group. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. Up till now, we've only made a short study of the company's growth data. You can do your own research on Left Field Printing Group and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Left Field Printing Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1540

Left Field Printing Group

An investment holding company, provides printing solutions and services in Australia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success