Spotlight On 3 Promising Penny Stocks With At Least US$200M Market Cap

Reviewed by Simply Wall St

Global markets have experienced a turbulent start to the year, with U.S. equities declining and small-cap stocks underperforming amid inflation concerns and political uncertainty. Despite these challenges, certain investment opportunities remain appealing, particularly in the realm of penny stocks. Though often seen as a relic of past trading days, penny stocks can still offer significant growth potential when backed by strong financials. This article will highlight three such promising companies that combine affordability with robust balance sheets, offering investors potential hidden value in quality firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £412.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.89 | £712.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.60 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,727 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Net-a-Go Technology (SEHK:1483)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net-a-Go Technology Company Limited, with a market cap of HK$1.03 billion, operates as an investment holding company providing environmental maintenance services in Hong Kong and Mainland China.

Operations: The company generates revenue primarily from its Environmental Maintenance Business, which accounts for HK$151.45 million, and also earns HK$2.51 million from its Property Leasing Business.

Market Cap: HK$1.03B

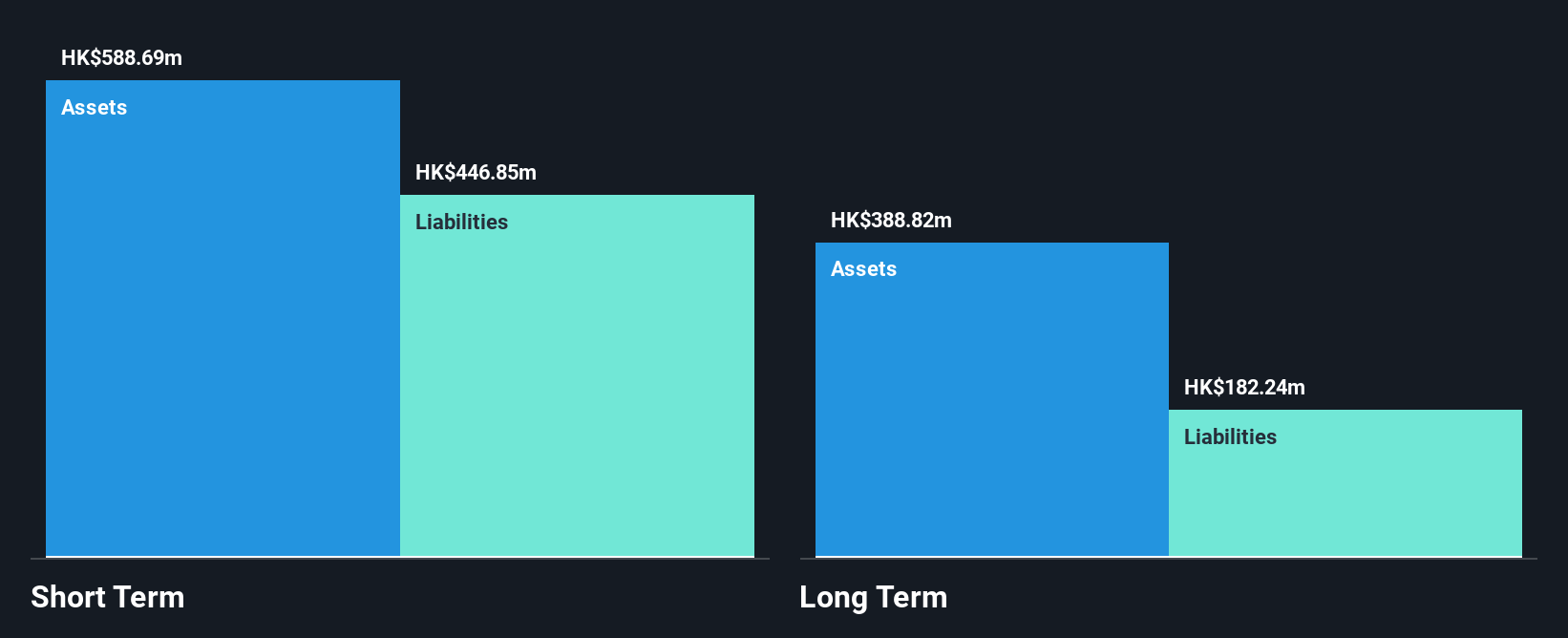

Net-a-Go Technology, with a market cap of HK$1.03 billion, primarily generates revenue from its Environmental Maintenance Business (HK$151.45 million) and Property Leasing (HK$2.51 million). Despite being unprofitable with declining earnings over the past five years, the company has a robust cash runway exceeding three years and more cash than total debt. Recent share buyback announcements could enhance net asset value per share and earnings per share. The board is experienced, but significant insider selling has occurred recently. Short-term assets cover both short- and long-term liabilities comfortably while trading below estimated fair value by 23.8%.

- Unlock comprehensive insights into our analysis of Net-a-Go Technology stock in this financial health report.

- Explore historical data to track Net-a-Go Technology's performance over time in our past results report.

Mewah International (SGX:MV4)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mewah International Inc. is an investment holding company that manufactures, refines, and sells vegetable oil products across various regions including Malaysia, Singapore, Asia, Africa, the Middle East, Pacific Oceania, the United States, and Europe with a market cap of SGD405.18 million.

Operations: The company's revenue is primarily derived from its Bulk segment, generating $2.97 billion, and its Consumer Pack segment, contributing $1.20 billion.

Market Cap: SGD405.18M

Mewah International, with a market cap of SGD405.18 million, derives substantial revenue from its Bulk (US$2.97 billion) and Consumer Pack (US$1.20 billion) segments. Despite experiencing negative earnings growth of 55.3% over the past year, the company has managed to maintain high-quality past earnings and stable weekly volatility at 5%. Its short-term assets comfortably cover both short- and long-term liabilities, while interest payments are well covered by EBIT at six times coverage. Although profit margins have decreased to 1.3%, the debt-to-equity ratio has improved to 55.2% over five years, indicating financial prudence amidst challenges in profitability growth acceleration.

- Click here and access our complete financial health analysis report to understand the dynamics of Mewah International.

- Examine Mewah International's past performance report to understand how it has performed in prior years.

Beingmate (SZSE:002570)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beingmate Co., Ltd. engages in the research, development, production, and sale of children's food and nutritious food products in China, with a market cap of CN¥3.97 billion.

Operations: The company generates CN¥2.70 billion in revenue from its operations within China.

Market Cap: CN¥3.97B

Beingmate Co., Ltd. recently achieved profitability, with earnings growth challenging to compare against its five-year average. The company reported a net income of CN¥71.79 million for the nine months ending September 2024, up from CN¥49.41 million the previous year, supported by a large one-off gain of CN¥105.6 million. Despite trading at a significant discount to its estimated fair value and having more cash than total debt, Beingmate's short-term assets do not fully cover its short-term liabilities. The board's inexperience and high share price volatility could present risks for investors considering penny stocks like Beingmate.

- Jump into the full analysis health report here for a deeper understanding of Beingmate.

- Gain insights into Beingmate's historical outcomes by reviewing our past performance report.

Where To Now?

- Dive into all 5,727 of the Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MV4

Mewah International

An investment holding company, manufactures, refines, and sells vegetable oil products products in Malaysia, Singapore, rest of Asia, Africa, the Middle East, Pacific Oceania, the United States, and Europe.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)