- Hong Kong

- /

- Professional Services

- /

- SEHK:1463

Subdued Growth No Barrier To C-Link Squared Limited (HKG:1463) With Shares Advancing 27%

C-Link Squared Limited (HKG:1463) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

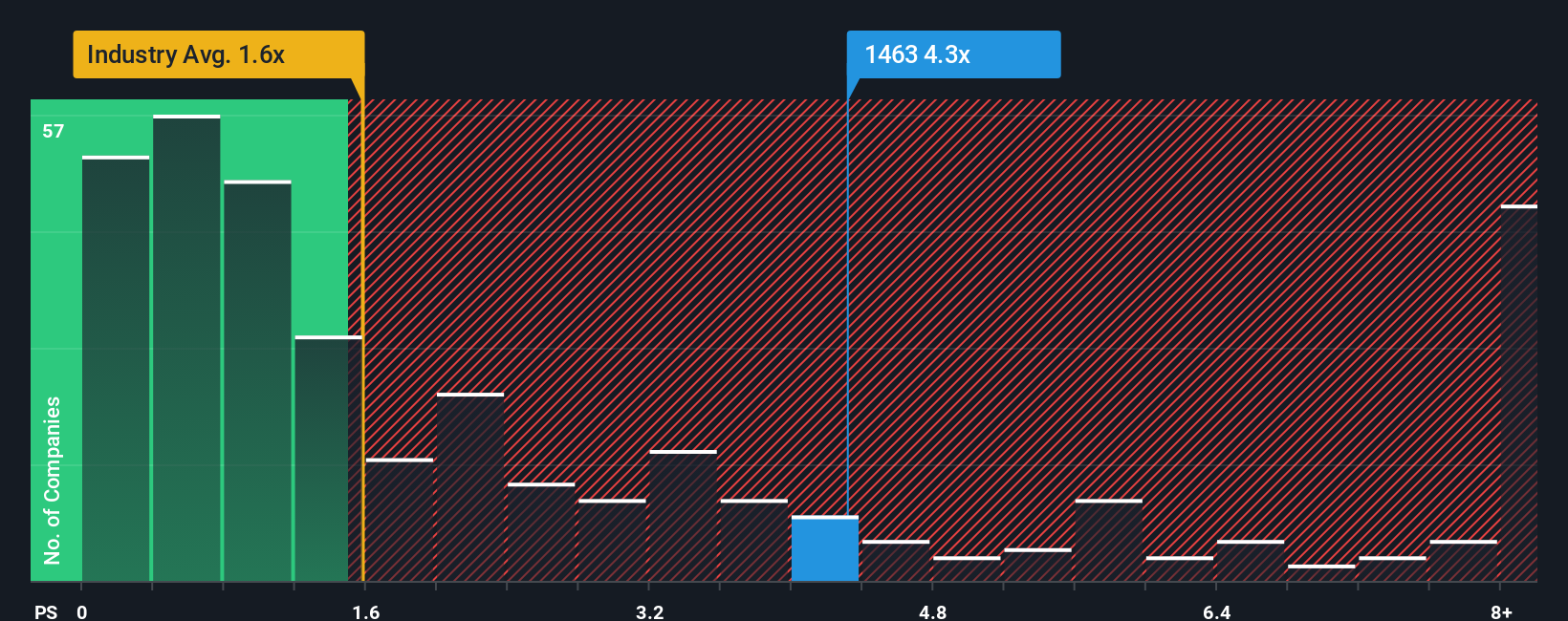

Since its price has surged higher, you could be forgiven for thinking C-Link Squared is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.3x, considering almost half the companies in Hong Kong's Professional Services industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for C-Link Squared

What Does C-Link Squared's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for C-Link Squared, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on C-Link Squared's earnings, revenue and cash flow.How Is C-Link Squared's Revenue Growth Trending?

C-Link Squared's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. Still, lamentably revenue has fallen 13% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 9.4% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that C-Link Squared's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in C-Link Squared have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of C-Link Squared revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware C-Link Squared is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1463

C-Link Squared

An investment holding company, provides outsourced data and document management services in Malaysia, Singapore, and the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives