- Hong Kong

- /

- Professional Services

- /

- SEHK:1463

C-Link Squared Limited's (HKG:1463) 34% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The C-Link Squared Limited (HKG:1463) share price has fared very poorly over the last month, falling by a substantial 34%. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

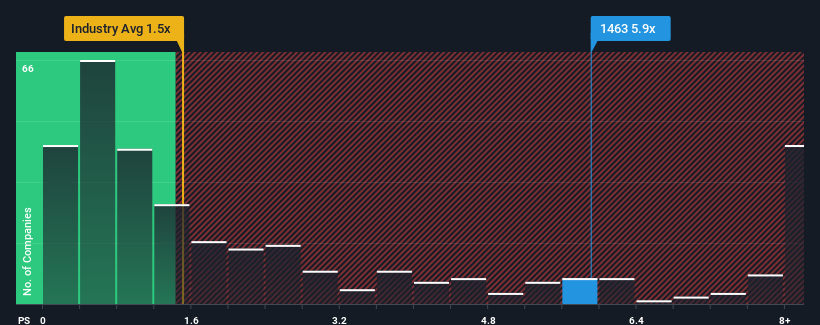

Even after such a large drop in price, when almost half of the companies in Hong Kong's Professional Services industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider C-Link Squared as a stock not worth researching with its 5.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for C-Link Squared

How Has C-Link Squared Performed Recently?

As an illustration, revenue has deteriorated at C-Link Squared over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on C-Link Squared will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like C-Link Squared's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 10% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that C-Link Squared's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From C-Link Squared's P/S?

C-Link Squared's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that C-Link Squared currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you take the next step, you should know about the 3 warning signs for C-Link Squared (2 are a bit concerning!) that we have uncovered.

If you're unsure about the strength of C-Link Squared's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1463

C-Link Squared

An investment holding company, provides outsourced data and document management services in Malaysia, Singapore, and the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives