- Hong Kong

- /

- Commercial Services

- /

- SEHK:145

Did Changing Sentiment Drive Hong Kong Building And Loan Agency's (HKG:145) Share Price Down A Painful 85%?

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Imagine if you held The Hong Kong Building And Loan Agency Limited (HKG:145) for half a decade as the share price tanked 85%. We also note that the stock has performed poorly over the last year, with the share price down 23%. Even worse, it's down 25% in about a month, which isn't fun at all.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Hong Kong Building And Loan Agency

Hong Kong Building And Loan Agency wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Hong Kong Building And Loan Agency saw its revenue increase by 28% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 32% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

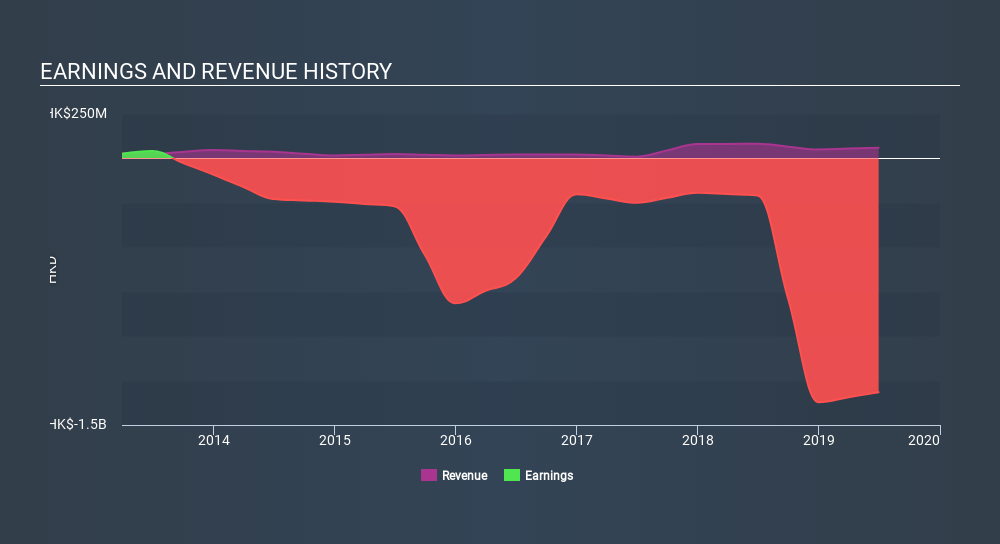

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Hong Kong Building And Loan Agency stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Hong Kong Building And Loan Agency shareholders are down 23% for the year. Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 32% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Hong Kong Building And Loan Agency has 4 warning signs (and 1 which is significant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:145

CCIAM Future Energy

An investment holding company, engages in the design and provision of energy saving solutions in Mainland China, Hong Kong, and Macau.

Excellent balance sheet with low risk.

Market Insights

Community Narratives