- Hong Kong

- /

- Commercial Services

- /

- SEHK:1354

Lacklustre Performance Is Driving Xi'an Kingfar Property Services Co., Ltd.'s (HKG:1354) 38% Price Drop

Unfortunately for some shareholders, the Xi'an Kingfar Property Services Co., Ltd. (HKG:1354) share price has dived 38% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

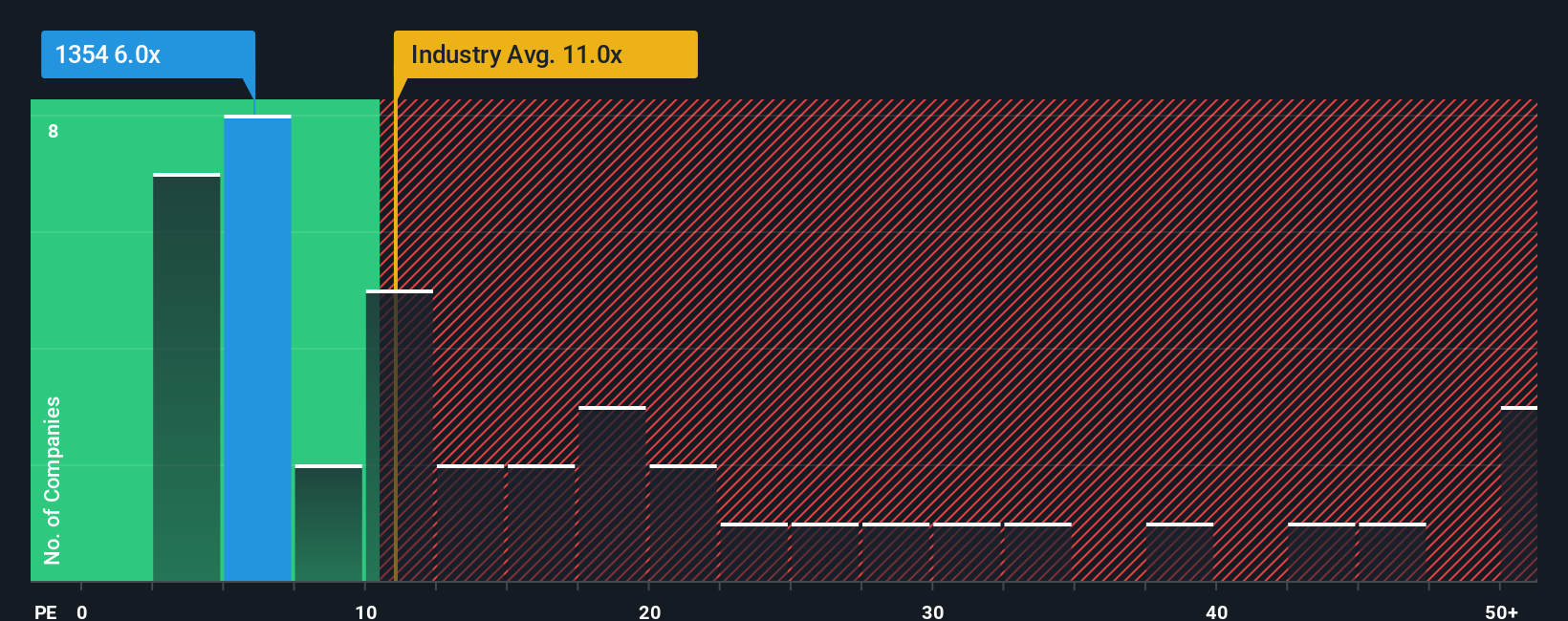

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Xi'an Kingfar Property Services as an attractive investment with its 6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

It looks like earnings growth has deserted Xi'an Kingfar Property Services recently, which is not something to boast about. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Xi'an Kingfar Property Services

What Are Growth Metrics Telling Us About The Low P/E?

Xi'an Kingfar Property Services' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Regardless, EPS has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Xi'an Kingfar Property Services is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Xi'an Kingfar Property Services' P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xi'an Kingfar Property Services maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Xi'an Kingfar Property Services (1 makes us a bit uncomfortable!) that we have uncovered.

Of course, you might also be able to find a better stock than Xi'an Kingfar Property Services. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1354

Xi'an Kingfar Property Services

Xi'an Kingfar Property Services Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives