- Hong Kong

- /

- Commercial Services

- /

- SEHK:1153

Jiayuan Services Holdings (HKG:1153) Is Paying Out A Larger Dividend Than Last Year

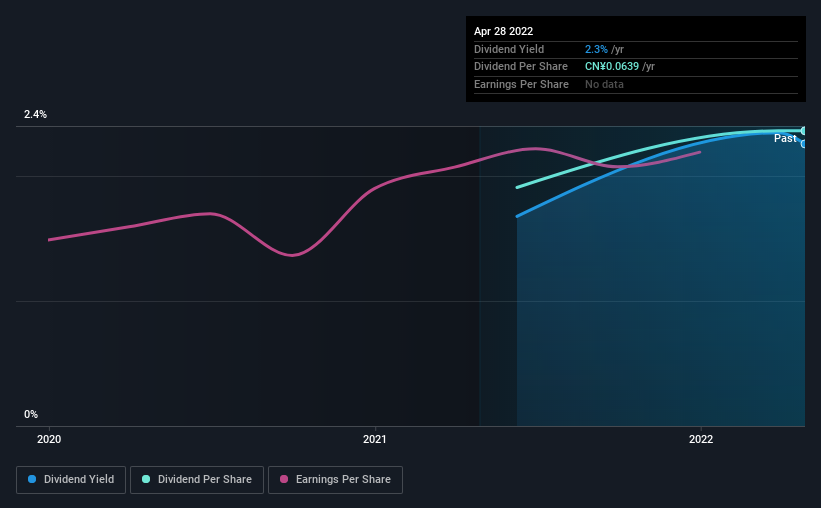

Jiayuan Services Holdings Limited (HKG:1153) will increase its dividend on the 8th of July to HK$0.079, which is 23% higher than last year. Although the dividend is now higher, the yield is only 2.3%, which is below the industry average.

View our latest analysis for Jiayuan Services Holdings

Jiayuan Services Holdings' Earnings Easily Cover the Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, prior to this announcement, Jiayuan Services Holdings' dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

If the trend of the last few years continues, EPS will grow by 15.4% over the next 12 months. If the dividend continues on this path, the payout ratio could be 51% by next year, which we think can be pretty sustainable going forward.

Jiayuan Services Holdings Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. EPS has grown 15% over the last 12 months. Rising earnings will make it easier for the company to keep paying dividends, and possibly even increase them. Jiayuan Services Holdings definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Jiayuan Services Holdings Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Are management backing themselves to deliver performance? Check their shareholdings in Jiayuan Services Holdings in our latest insider ownership analysis. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1153

Jiayuan Services Holdings

Provides property management services to property owners, property developers, residents, and tenants in the People’s Republic of China.

Slight and slightly overvalued.

Market Insights

Community Narratives