- Hong Kong

- /

- Construction

- /

- SEHK:9938

Wah Wo Holdings Group Limited (HKG:9938) Stocks Shoot Up 35% But Its P/S Still Looks Reasonable

The Wah Wo Holdings Group Limited (HKG:9938) share price has done very well over the last month, posting an excellent gain of 35%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

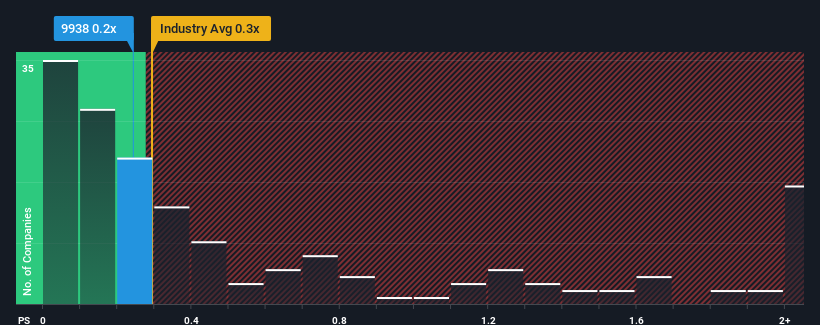

Although its price has surged higher, it's still not a stretch to say that Wah Wo Holdings Group's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Construction industry in Hong Kong, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Wah Wo Holdings Group

What Does Wah Wo Holdings Group's Recent Performance Look Like?

Wah Wo Holdings Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Wah Wo Holdings Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wah Wo Holdings Group will help you shine a light on its historical performance.How Is Wah Wo Holdings Group's Revenue Growth Trending?

Wah Wo Holdings Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 115% gain to the company's top line. The latest three year period has also seen a 24% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 8.8% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Wah Wo Holdings Group's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Wah Wo Holdings Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've seen, Wah Wo Holdings Group's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You need to take note of risks, for example - Wah Wo Holdings Group has 3 warning signs (and 2 which are a bit concerning) we think you should know about.

If these risks are making you reconsider your opinion on Wah Wo Holdings Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wah Wo Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9938

Wah Wo Holdings Group

An investment holding company, engages in the provision of aluminium works and related services in Hong Kong.

Excellent balance sheet and good value.

Market Insights

Community Narratives