As October 2025 unfolds, Asian markets are navigating a complex landscape marked by trade tensions and economic recalibrations. Amid these conditions, investors are increasingly looking towards smaller or newer companies that offer growth potential at more accessible price points. While the term "penny stocks" may seem outdated, it still captures the essence of discovering opportunities in lesser-known equities with strong financials and growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.90 | THB1.33B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.18 | SGD478.24M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.68 | THB2.8B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.44 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply and catering chain, as well as environmental protection and technology sectors in China and Hong Kong, with a market cap of HK$1.99 billion.

Operations: The company's revenue is primarily derived from food supply (HK$1.09 billion), with additional contributions from catering services (HK$59.04 million) and environmental protection and technology services (HK$0.96 million).

Market Cap: HK$2B

China Wantian Holdings Limited has seen a significant increase in sales, reaching HK$614.89 million for the first half of 2025, but remains unprofitable with a net loss of HK$46.74 million. Despite a reduction in its debt-to-equity ratio from 45.3% to 3.6% over five years and having more cash than total debt, the company faces financial challenges with less than a year of cash runway and increased volatility in share price. Recent removal from the S&P Global BMI Index highlights market concerns amid ongoing expansion efforts in food supply and catering services within China and Hong Kong.

- Click here to discover the nuances of China Wantian Holdings with our detailed analytical financial health report.

- Gain insights into China Wantian Holdings' past trends and performance with our report on the company's historical track record.

Hong Kong Zcloud Technology Construction (SEHK:9900)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hong Kong Zcloud Technology Construction Limited is an investment holding company that provides subcontracting works for public and private sectors in Hong Kong, with a market cap of HK$12.80 billion.

Operations: The company generates revenue of HK$1.28 billion from its provision of building construction services and RMAA services.

Market Cap: HK$12.8B

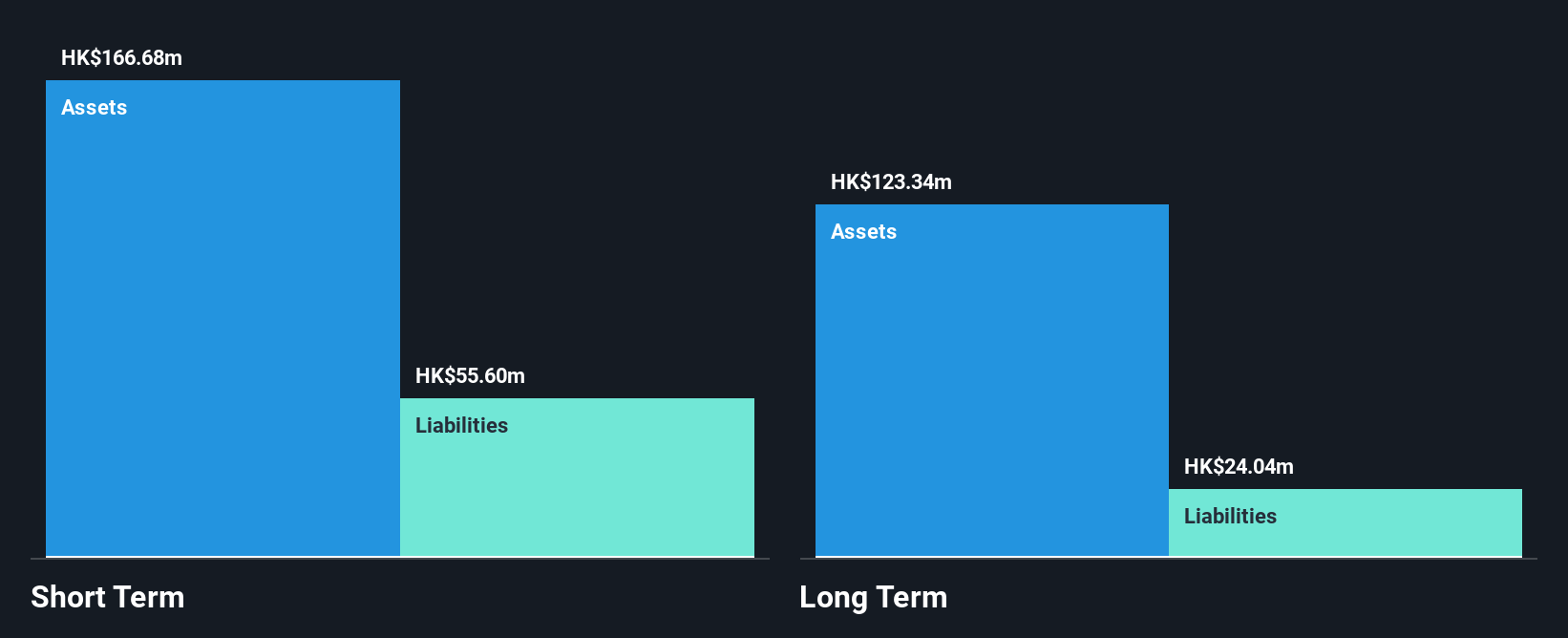

Hong Kong Zcloud Technology Construction Limited, with a market cap of HK$12.80 billion, recently joined the S&P Global BMI Index following an 8:1 stock split. The company boasts high-quality earnings and has seen profit growth accelerate to 12.1% over the past year, outpacing industry averages. Despite its low return on equity at 11.7%, it maintains a strong financial position with short-term assets exceeding both short and long-term liabilities significantly. However, volatility remains high compared to most Hong Kong stocks and its board and management team are relatively inexperienced with an average tenure of just 0.7 years.

- Get an in-depth perspective on Hong Kong Zcloud Technology Construction's performance by reading our balance sheet health report here.

- Learn about Hong Kong Zcloud Technology Construction's historical performance here.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanJi E-Commerce Co., LTD operates in China offering brand licensing and comprehensive mobile Internet marketing services, with a market cap of CN¥8.10 billion.

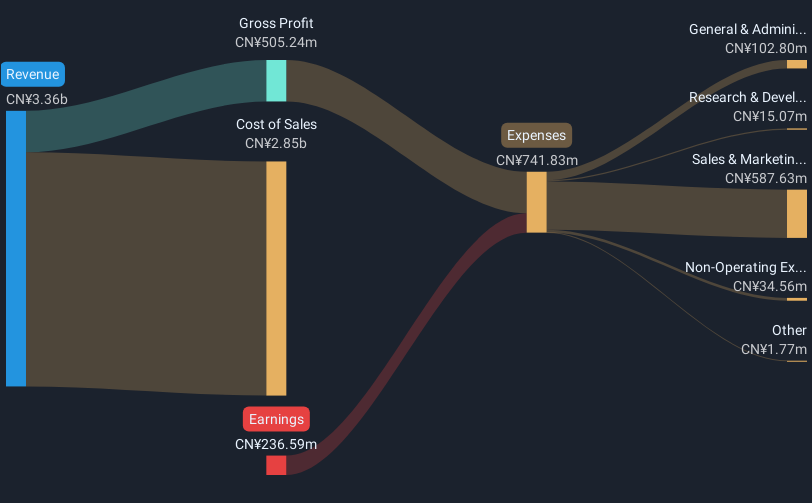

Operations: The company's revenue is primarily derived from its Time Interconnection Business, generating CN¥2.62 billion, and the Antarctic E-Commerce Headquarters Business, contributing CN¥539.64 million.

Market Cap: CN¥8.1B

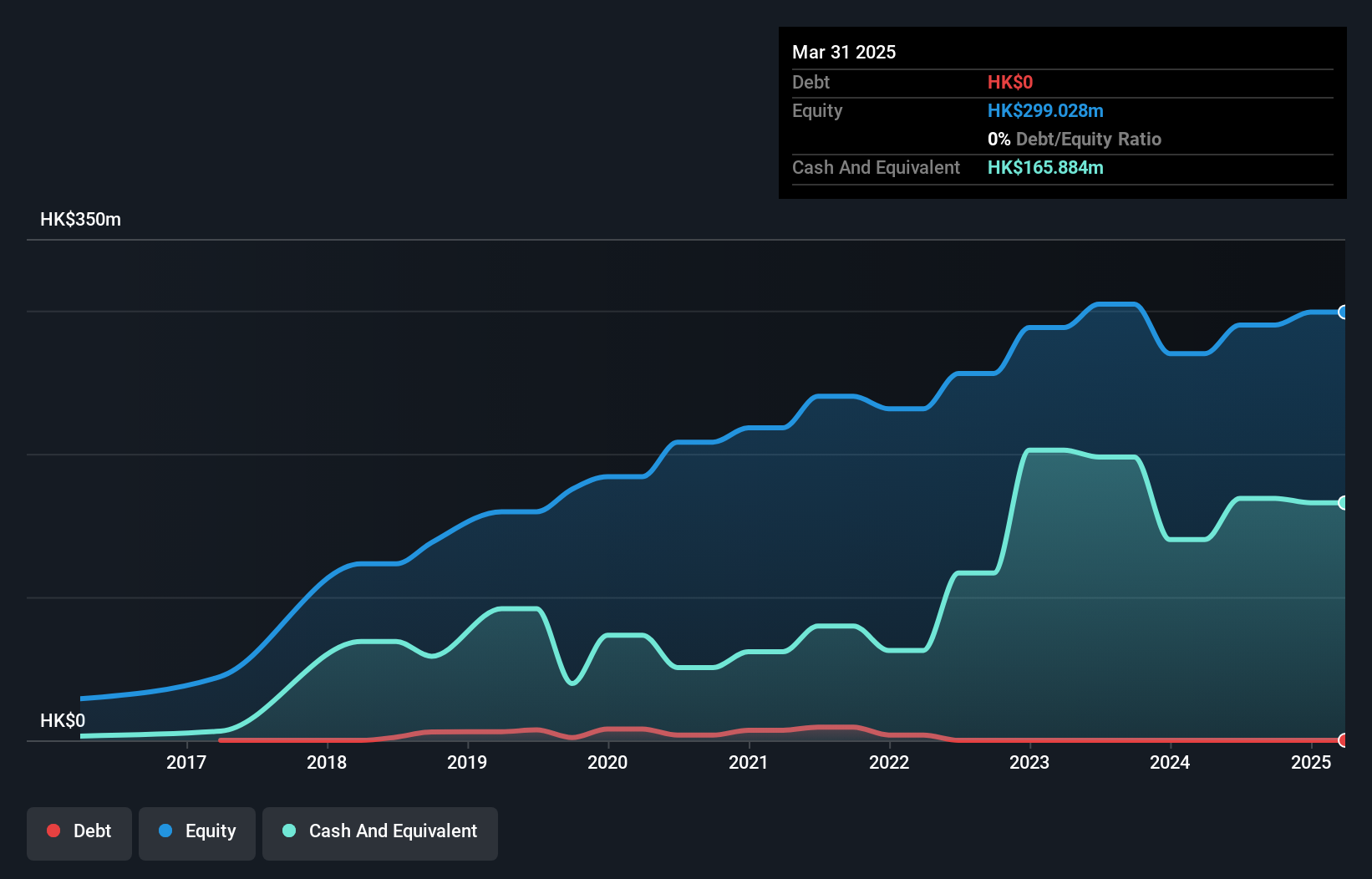

NanJi E-Commerce, with a market cap of CN¥8.10 billion, operates debt-free and has stable short-term assets of CN¥3.4 billion covering both short and long-term liabilities. Despite being unprofitable with a negative return on equity of -7.39%, the company forecasts earnings growth at 78.12% annually, though past losses have increased significantly over five years. Recent amendments to its articles of association suggest strategic shifts in governance, while recent earnings show decreased revenue and net income compared to the previous year. The management team is experienced with an average tenure of 3.2 years, contrasting with an inexperienced board averaging 2.5 years' tenure.

- Click to explore a detailed breakdown of our findings in NanJi E-Commerce's financial health report.

- Understand NanJi E-Commerce's earnings outlook by examining our growth report.

Summing It All Up

- Embark on your investment journey to our 955 Asian Penny Stocks selection here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand licensing and comprehensive and mobile Internet marketing services in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives