- Hong Kong

- /

- Construction

- /

- SEHK:9893

Pizu Group Holdings (SEHK:9893) Margins Jump to 11.8%, Reinforcing Bulls Despite Volatility Concerns

Reviewed by Simply Wall St

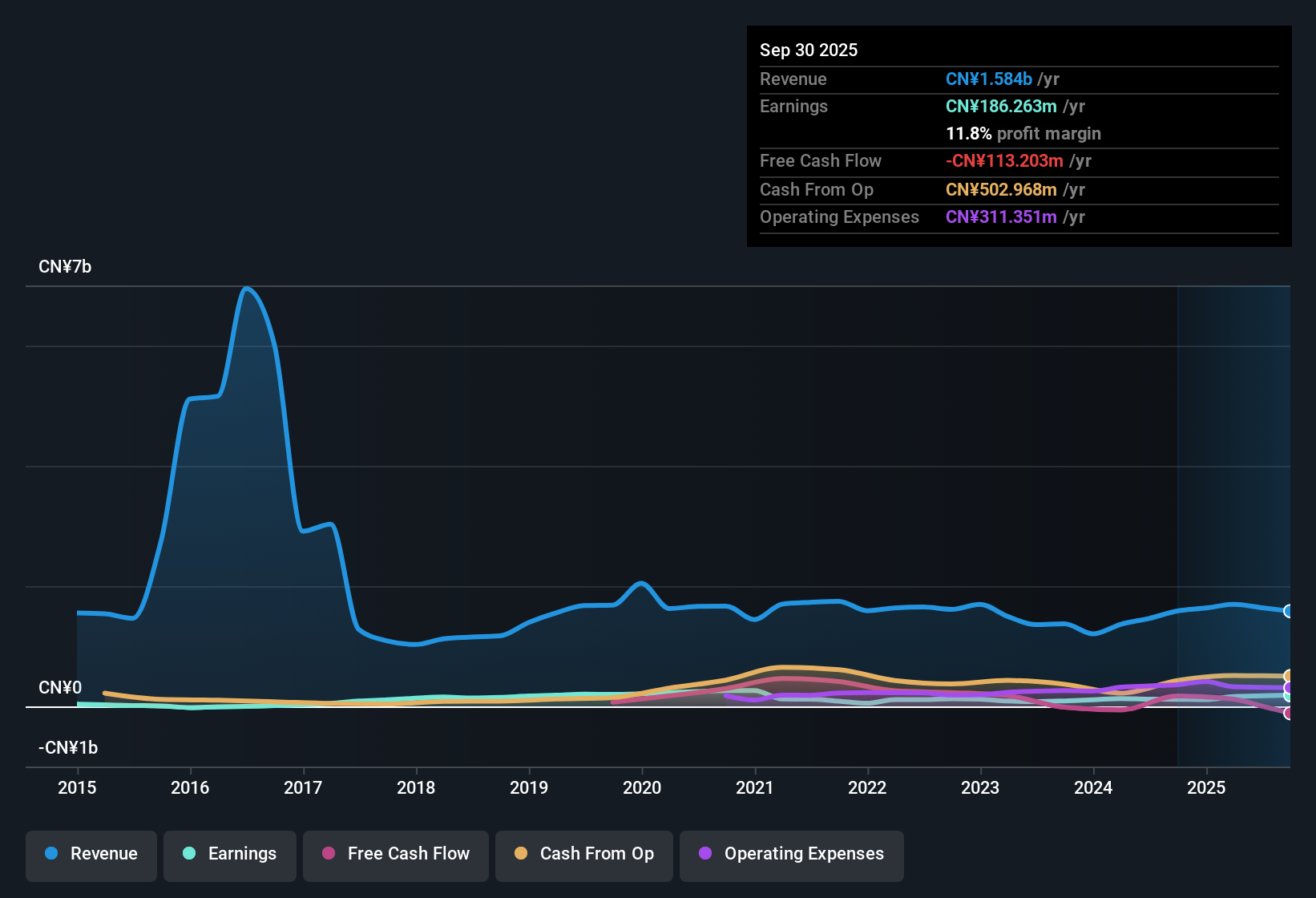

Pizu Group Holdings (SEHK:9893) released its H1 2026 results, reporting revenue of 859.2 million CNY and basic EPS of 0.024446 CNY. Over recent periods, revenue moved from 639.2 million CNY in H1 2024 to 836.3 million CNY in H2 2025 before landing at the latest figures, while basic EPS declined from 0.028244 CNY in H1 2024. The results show profitability and margins remain key points of focus as investors digest the latest update.

See our full analysis for Pizu Group Holdings.Next, we’re lining up these headline numbers against the prevailing narratives at Simply Wall St to see which expectations get confirmed, and where the real surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Expand to 11.8% Despite Earlier Declines

- Net profit margin improved to 11.8% over the last twelve months, a notable rise from 7.5% in the previous year, even though the company saw a 3.1% average decline in earnings per year over the prior five-year span.

- What stands out is that, while the recent margin improvement heavily supports the current bullish argument for quality earnings, the underlying track record brings tension for long-term bulls:

- The sharp margin jump aligns with the recent 57.5% earnings growth, showing operational strength not seen in past years.

- However, multi-year profit decline tempers enthusiasm and urges investors to look beyond the strong snapback when setting expectations for sustained margin gains.

P/E Above Industry but Below Peers

- The current price-to-earnings ratio is 16.5x, which tops the Hong Kong Construction industry average of 10.7x but remains well under the peer group average of 25.9x.

- This P/E positioning creates debate about valuation. Investors see the stock as priced for moderate growth, yet not at the premiums where top peers trade.

- With the share price at 0.95, only slightly higher than the 0.927 DCF fair value, the narrative reflects optimism about profitability, but not enough to command peer-level multiples.

- This gap suggests the market is cautiously rewarding the company’s margin improvements while staying mindful of volatility and past underperformance.

Insider Selling and Share Price Volatility

- Shares have moved erratically over the past three months, coinciding with significant insider selling, which puts recent upward momentum in sharper context.

- Market commentary notes that, despite high-quality earnings growth, the insider selling and volatility may keep some investors on the sidelines for now.

- The tension between higher reported profitability and the actions of company insiders serves as a real-world gut check on how much faith the market puts in short-term results.

- This theme, along with a history of multi-year earnings declines, makes the risk/reward profile more nuanced than just the margin or profit headlines suggest.

If you want to see how these cross-currents play out in the full discussion, dive into the structured narratives for a deeper, story-driven analysis. See what the community is saying about Pizu Group Holdings

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pizu Group Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Pizu Group Holdings shows encouraging margin recovery, but its history of multi-year profit declines and recent volatility give investors reason to remain cautious about future stability.

If you want confidence in steadier financial performance, check out stable growth stocks screener (2074 results) to find companies that consistently expand earnings and minimize surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9893

Pizu Group Holdings

An investment holding company, manufactures, trades, and sales of civil explosives in the People's Republic of China and Tajikistan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.