- Hong Kong

- /

- Trade Distributors

- /

- SEHK:936

If You Had Bought Eagle Legend Asia's (HKG:936) Shares Five Years Ago You Would Be Down 73%

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Imagine if you held Eagle Legend Asia Limited (HKG:936) for half a decade as the share price tanked 73%. And we doubt long term believers are the only worried holders, since the stock price has declined 33% over the last twelve months. The falls have accelerated recently, with the share price down 19% in the last three months.

View our latest analysis for Eagle Legend Asia

Eagle Legend Asia isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Eagle Legend Asia saw its revenue shrink by 19% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 12% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

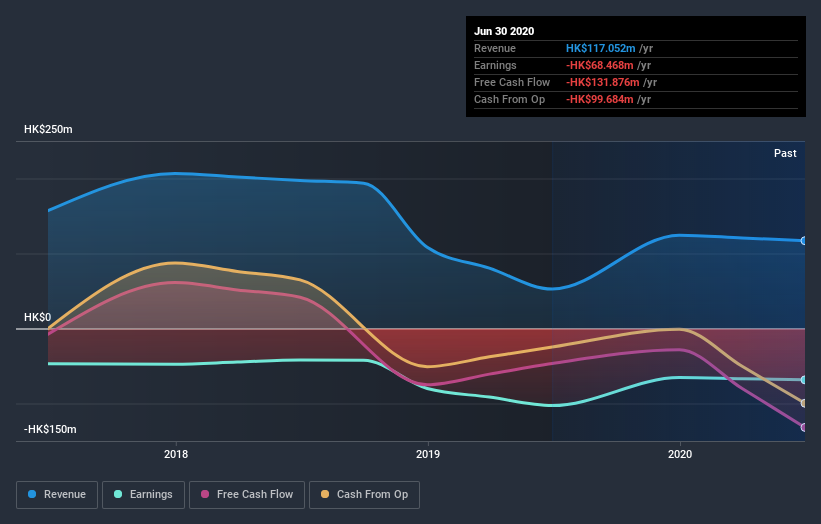

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Eagle Legend Asia had a tough year, with a total loss of 33%, against a market gain of about 6.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Eagle Legend Asia better, we need to consider many other factors. Even so, be aware that Eagle Legend Asia is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

We will like Eagle Legend Asia better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Eagle Legend Asia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaisa Capital Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:936

Kaisa Capital Investment Holdings

An investment holding company, trades in construction machinery and spare parts primarily in Hong Kong, Singapore, and the People’s Republic of China.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives