- Hong Kong

- /

- Construction

- /

- SEHK:8526

Some Confidence Is Lacking In Wing Fung Group Asia Limited's (HKG:8526) P/S

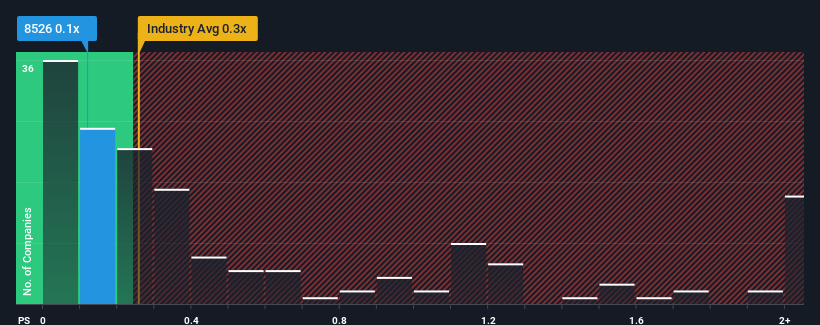

There wouldn't be many who think Wing Fung Group Asia Limited's (HKG:8526) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Construction industry in Hong Kong is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Wing Fung Group Asia

What Does Wing Fung Group Asia's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Wing Fung Group Asia over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wing Fung Group Asia's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Wing Fung Group Asia?

In order to justify its P/S ratio, Wing Fung Group Asia would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.9% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Wing Fung Group Asia's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Wing Fung Group Asia currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Having said that, be aware Wing Fung Group Asia is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Wing Fung Group Asia, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Wing Fung Group Asia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wing Fung Group Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8526

Wing Fung Group Asia

An investment holding company, provides supply, installation, and fitting-out services of mechanical ventilation and air-conditioning systems for buildings in Hong Kong and Macau.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives