Take Care Before Jumping Onto EVA Precision Industrial Holdings Limited (HKG:838) Even Though It's 25% Cheaper

EVA Precision Industrial Holdings Limited (HKG:838) shares have had a horrible month, losing 25% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 29% in the last year.

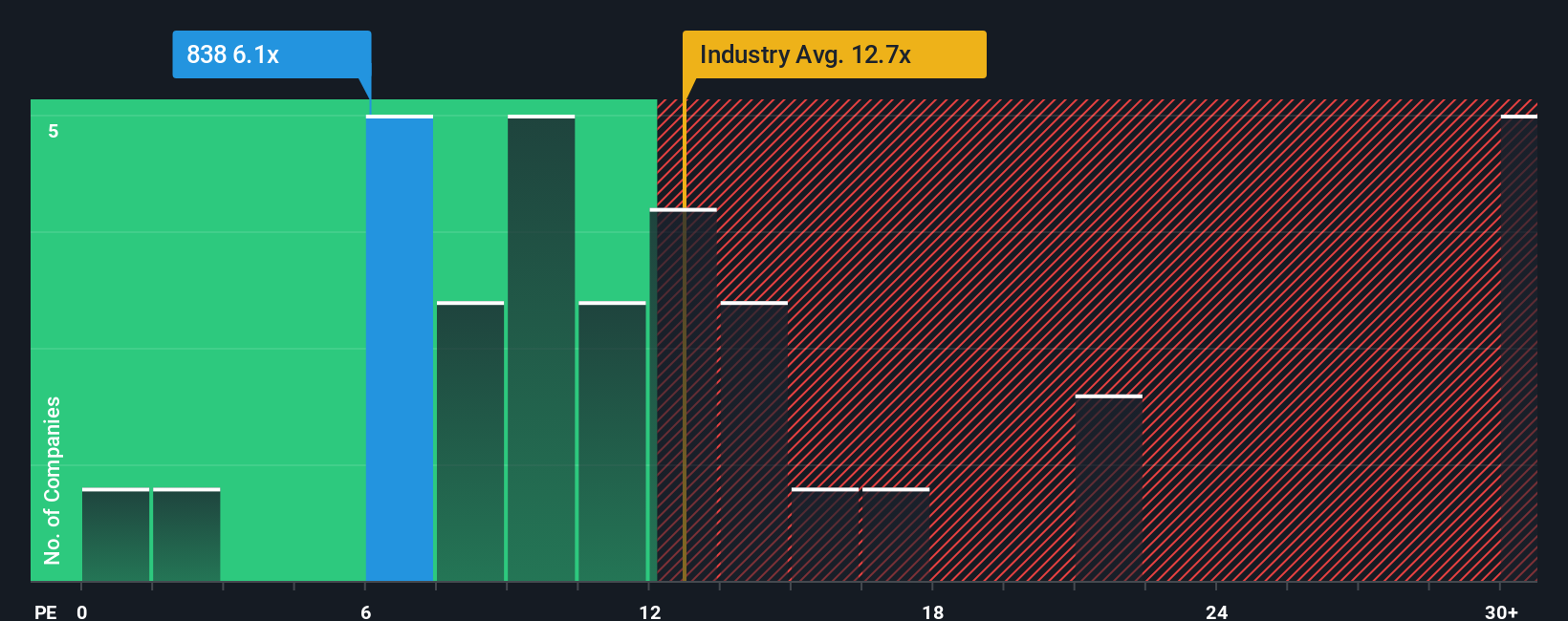

Since its price has dipped substantially, EVA Precision Industrial Holdings' price-to-earnings (or "P/E") ratio of 6.1x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 25x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

EVA Precision Industrial Holdings' earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for EVA Precision Industrial Holdings

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, EVA Precision Industrial Holdings would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.8% last year. This was backed up an excellent period prior to see EPS up by 33% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 21% over the next year. Meanwhile, the rest of the market is forecast to expand by 21%, which is not materially different.

With this information, we find it odd that EVA Precision Industrial Holdings is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On EVA Precision Industrial Holdings' P/E

Shares in EVA Precision Industrial Holdings have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that EVA Precision Industrial Holdings currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Having said that, be aware EVA Precision Industrial Holdings is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on EVA Precision Industrial Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EVA Precision Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:838

EVA Precision Industrial Holdings

An investment holding company, provides precision manufacturing services in the People’s Republic of China, Vietnam, and Mexico.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026