- Hong Kong

- /

- Trade Distributors

- /

- SEHK:8152

Returns At M&L Holdings Group (HKG:8152) Appear To Be Weighed Down

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating M&L Holdings Group (HKG:8152), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What Is It?

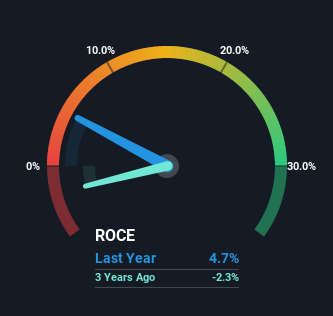

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for M&L Holdings Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.047 = HK$4.9m ÷ (HK$195m - HK$91m) (Based on the trailing twelve months to March 2023).

So, M&L Holdings Group has an ROCE of 4.7%. On its own, that's a low figure but it's around the 5.5% average generated by the Trade Distributors industry.

See our latest analysis for M&L Holdings Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating M&L Holdings Group's past further, check out this free graph of past earnings, revenue and cash flow.

SWOT Analysis for M&L Holdings Group

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Trading below our estimate of fair value by more than 20%.

- Lack of analyst coverage makes it difficult to determine 8152's earnings prospects.

- No apparent threats visible for 8152.

How Are Returns Trending?

We're a bit concerned with the trends, because the business is applying 20% less capital than it was five years ago and returns on that capital have stayed flat. This indicates to us that assets are being sold and thus the business is likely shrinking, which you'll remember isn't the typical ingredients for an up-and-coming multi-bagger. Not only that, but the low returns on this capital mentioned earlier would leave most investors unimpressed.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 47% of total assets, this reported ROCE would probably be less than4.7% because total capital employed would be higher.The 4.7% ROCE could be even lower if current liabilities weren't 47% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

Our Take On M&L Holdings Group's ROCE

In summary, M&L Holdings Group isn't reinvesting funds back into the business and returns aren't growing. It seems that investors have little hope of these trends getting any better and that may have partly contributed to the stock collapsing 85% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

One more thing to note, we've identified 2 warning signs with M&L Holdings Group and understanding these should be part of your investment process.

While M&L Holdings Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8152

M&L Holdings Group

An investment holding company, engages in the trading and leasing of construction machinery and spare parts in the People's Republic of China, Hong Kong, Vietnam, other Asia Pacific countries, the United States, Australia, and internationally.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives