- Hong Kong

- /

- Trade Distributors

- /

- SEHK:8152

If You Had Bought M&L Holdings Group (HKG:8152) Stock A Year Ago, You'd Be Sitting On A 34% Loss, Today

While not a mind-blowing move, it is good to see that the M&L Holdings Group Limited (HKG:8152) share price has gained 10% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 34% in the last year, significantly under-performing the market.

Check out our latest analysis for M&L Holdings Group

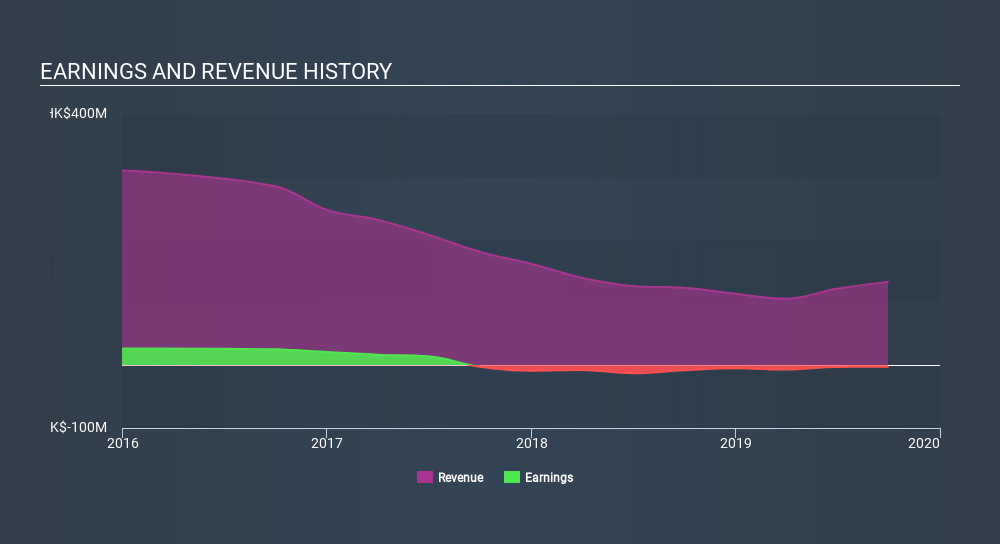

Because M&L Holdings Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year M&L Holdings Group saw its revenue grow by 7.7%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 34% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on M&L Holdings Group's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 9.4% in the last year, M&L Holdings Group shareholders might be miffed that they lost 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 10%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand M&L Holdings Group better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with M&L Holdings Group .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:8152

M&L Holdings Group

An investment holding company, engages in the trading and leasing of construction machinery and spare parts in the People's Republic of China, Hong Kong, Vietnam, other Asia Pacific countries, the United States, Australia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives