- Hong Kong

- /

- Gas Utilities

- /

- SEHK:8007

Global Strategic Group (HKG:8007) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Global Strategic Group Limited (HKG:8007) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Global Strategic Group

What Is Global Strategic Group's Net Debt?

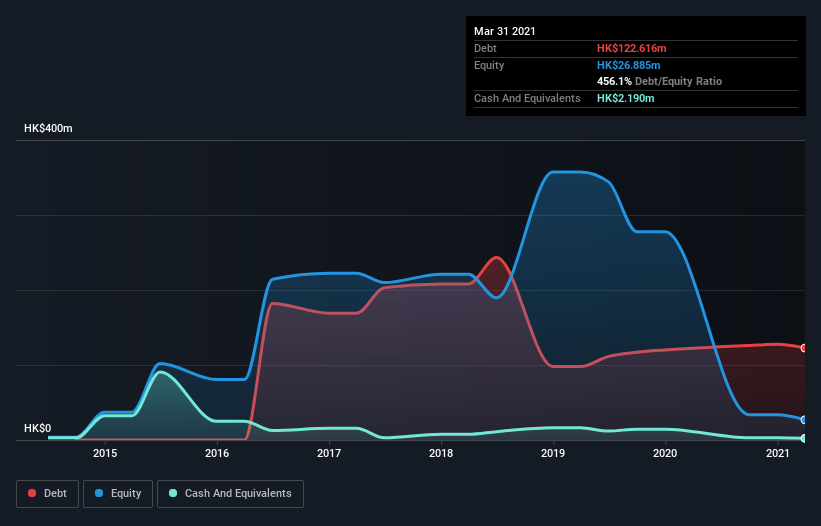

As you can see below, Global Strategic Group had HK$122.6m of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Global Strategic Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Global Strategic Group had liabilities of HK$131.1m due within 12 months and liabilities of HK$68.5m due beyond that. Offsetting this, it had HK$2.19m in cash and HK$32.3m in receivables that were due within 12 months. So it has liabilities totalling HK$165.1m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the HK$19.5m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Global Strategic Group would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Global Strategic Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Global Strategic Group reported revenue of HK$56m, which is a gain of 17%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months Global Strategic Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable HK$37m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Sure, the company might have a nice story about how they are going on to a brighter future. But the fact is that it incinerated HK$4.4m of cash in the last twelve months, and has precious few liquid assets in comparison to its liabilities. So is this a high risk stock? We think so, and we'd avoid it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Global Strategic Group you should be aware of, and 2 of them don't sit too well with us.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8007

Global Strategic Group

An investment holding company, supplies natural gas in the People’s Republic of China.

Slightly overvalued with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026