Singamas Container Holdings (HKG:716) Has A Somewhat Strained Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Singamas Container Holdings Limited (HKG:716) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Singamas Container Holdings

What Is Singamas Container Holdings's Net Debt?

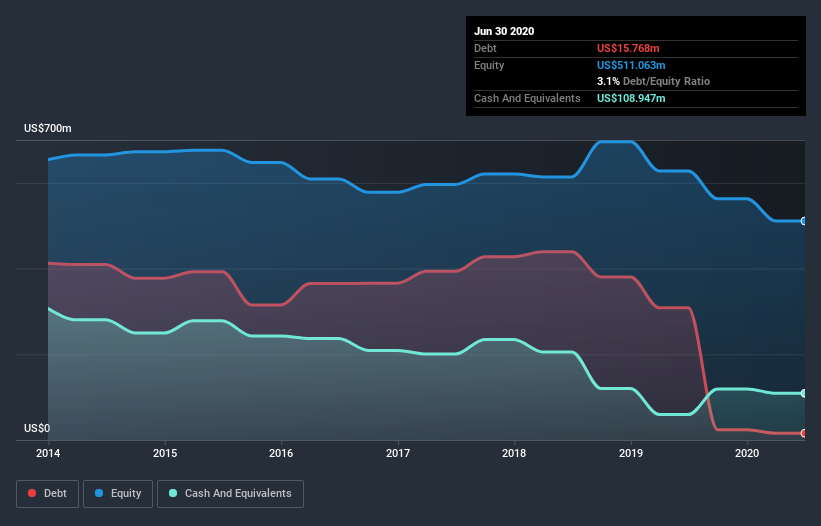

The image below, which you can click on for greater detail, shows that Singamas Container Holdings had debt of US$15.8m at the end of June 2020, a reduction from US$308.5m over a year. However, it does have US$108.9m in cash offsetting this, leading to net cash of US$93.2m.

How Strong Is Singamas Container Holdings's Balance Sheet?

According to the last reported balance sheet, Singamas Container Holdings had liabilities of US$122.6m due within 12 months, and liabilities of US$7.10m due beyond 12 months. Offsetting this, it had US$108.9m in cash and US$42.7m in receivables that were due within 12 months. So it can boast US$21.9m more liquid assets than total liabilities.

This short term liquidity is a sign that Singamas Container Holdings could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Singamas Container Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Singamas Container Holdings's saving grace is its low debt levels, because its EBIT has tanked 93% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is Singamas Container Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Singamas Container Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Singamas Container Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Singamas Container Holdings has net cash of US$93.2m, as well as more liquid assets than liabilities. So although we see some areas for improvement, we're not too worried about Singamas Container Holdings's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Singamas Container Holdings (of which 1 is a bit concerning!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Singamas Container Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:716

Singamas Container Holdings

An investment holding company, manufactures and sells containers and other related products.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026