- Hong Kong

- /

- Construction

- /

- SEHK:711

Interested In Asia Allied Infrastructure Holdings' (HKG:711) Upcoming HK$0.0083 Dividend? You Have Three Days Left

Asia Allied Infrastructure Holdings Limited (HKG:711) stock is about to trade ex-dividend in three days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Asia Allied Infrastructure Holdings' shares before the 12th of December in order to receive the dividend, which the company will pay on the 7th of January.

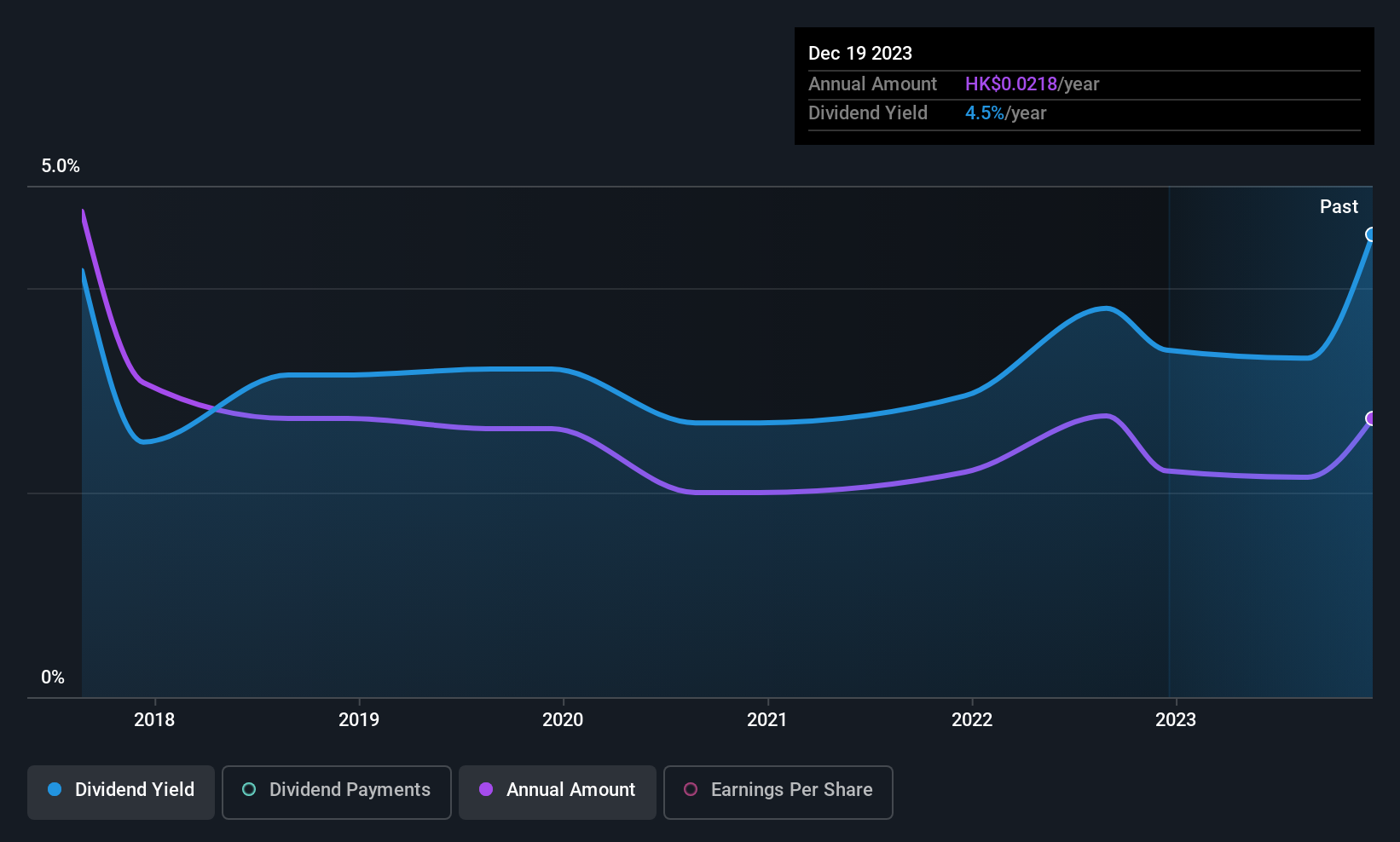

The company's next dividend payment will be HK$0.0083 per share. Last year, in total, the company distributed HK$0.017 to shareholders. Calculating the last year's worth of payments shows that Asia Allied Infrastructure Holdings has a trailing yield of 3.8% on the current share price of HK$0.435. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Asia Allied Infrastructure Holdings can afford its dividend, and if the dividend could grow.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Asia Allied Infrastructure Holdings paid out a comfortable 30% of its profit last year.

See our latest analysis for Asia Allied Infrastructure Holdings

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Asia Allied Infrastructure Holdings's earnings per share have dropped 13% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Asia Allied Infrastructure Holdings's dividend payments per share have declined at 9.8% per year on average over the past eight years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

Should investors buy Asia Allied Infrastructure Holdings for the upcoming dividend? Asia Allied Infrastructure Holdings's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. In summary, Asia Allied Infrastructure Holdings appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

In light of that, while Asia Allied Infrastructure Holdings has an appealing dividend, it's worth knowing the risks involved with this stock. For instance, we've identified 3 warning signs for Asia Allied Infrastructure Holdings (2 are concerning) you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:711

Asia Allied Infrastructure Holdings

An investment holding company, engages in civil engineering, electrical and mechanical engineering, and foundation and building construction work businesses in Hong Kong, the United Arab Emirates, and internationally.

Fair value second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026