Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies NWS Holdings Limited (HKG:659) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for NWS Holdings

How Much Debt Does NWS Holdings Carry?

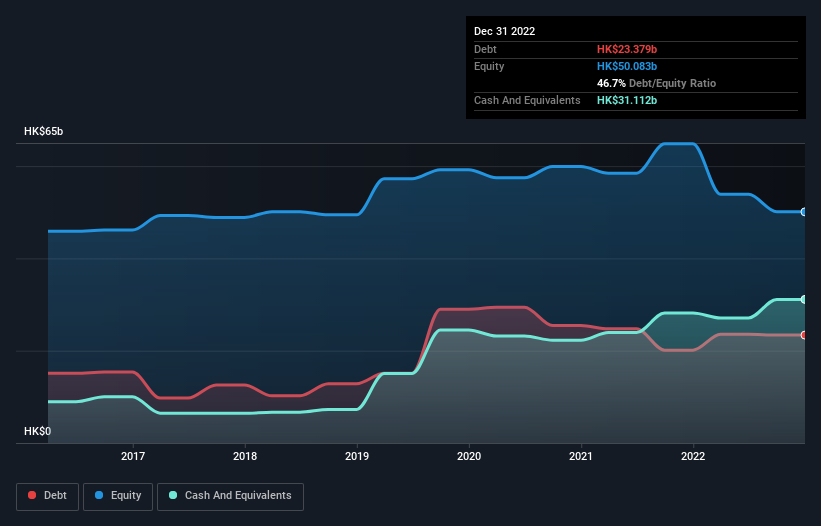

As you can see below, at the end of December 2022, NWS Holdings had HK$23.4b of debt, up from HK$20.1b a year ago. Click the image for more detail. But on the other hand it also has HK$31.1b in cash, leading to a HK$7.73b net cash position.

A Look At NWS Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that NWS Holdings had liabilities of HK$62.0b due within 12 months and liabilities of HK$36.5b due beyond that. Offsetting these obligations, it had cash of HK$31.1b as well as receivables valued at HK$9.59b due within 12 months. So it has liabilities totalling HK$57.8b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the HK$26.9b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, NWS Holdings would likely require a major re-capitalisation if it had to pay its creditors today. Given that NWS Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Although NWS Holdings made a loss at the EBIT level, last year, it was also good to see that it generated HK$2.9b in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if NWS Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. NWS Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, NWS Holdings actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While NWS Holdings does have more liabilities than liquid assets, it also has net cash of HK$7.73b. And it impressed us with free cash flow of HK$4.1b, being 142% of its EBIT. So although we see some areas for improvement, we're not too worried about NWS Holdings's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - NWS Holdings has 3 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:659

CTF Services

A conglomerate company with a diversified portfolio of businesses in toll roads, insurance, logistics, construction, and facilities management primarily in Hong Kong and the Mainland.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success