We Think Sany Heavy Equipment International Holdings (HKG:631) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Sany Heavy Equipment International Holdings Company Limited (HKG:631) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Sany Heavy Equipment International Holdings

How Much Debt Does Sany Heavy Equipment International Holdings Carry?

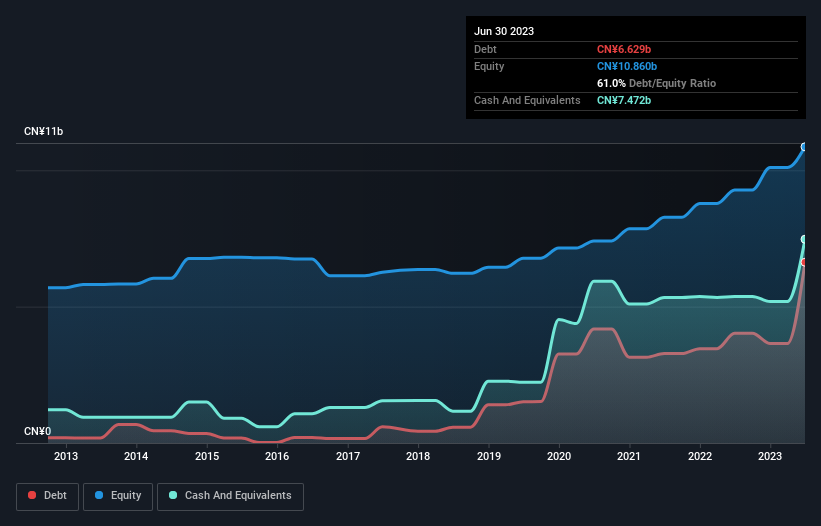

You can click the graphic below for the historical numbers, but it shows that as of June 2023 Sany Heavy Equipment International Holdings had CN¥6.63b of debt, an increase on CN¥4.02b, over one year. But on the other hand it also has CN¥7.47b in cash, leading to a CN¥842.7m net cash position.

How Healthy Is Sany Heavy Equipment International Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Sany Heavy Equipment International Holdings had liabilities of CN¥18.5b due within 12 months and liabilities of CN¥6.59b due beyond that. Offsetting this, it had CN¥7.47b in cash and CN¥10.8b in receivables that were due within 12 months. So its liabilities total CN¥6.88b more than the combination of its cash and short-term receivables.

Since publicly traded Sany Heavy Equipment International Holdings shares are worth a total of CN¥36.1b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Sany Heavy Equipment International Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Sany Heavy Equipment International Holdings grew its EBIT by 138% over twelve months. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Sany Heavy Equipment International Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Sany Heavy Equipment International Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Considering the last three years, Sany Heavy Equipment International Holdings actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing Up

Although Sany Heavy Equipment International Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥842.7m. And we liked the look of last year's 138% year-on-year EBIT growth. So we are not troubled with Sany Heavy Equipment International Holdings's debt use. We'd be motivated to research the stock further if we found out that Sany Heavy Equipment International Holdings insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:631

Sany Heavy Equipment International Holdings

Manufactures and sells mining and logistics equipment, electricity, power station project products, petroleum and new energy manufacturing equipment, spare parts, and related services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives