- Hong Kong

- /

- Electrical

- /

- SEHK:580

We Ran A Stock Scan For Earnings Growth And Sun.King Technology Group (HKG:580) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Sun.King Technology Group (HKG:580). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Sun.King Technology Group Growing Its Earnings Per Share?

In the last three years Sun.King Technology Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Sun.King Technology Group's EPS catapulted from CN¥0.044 to CN¥0.10, over the last year. It's not often a company can achieve year-on-year growth of 132%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

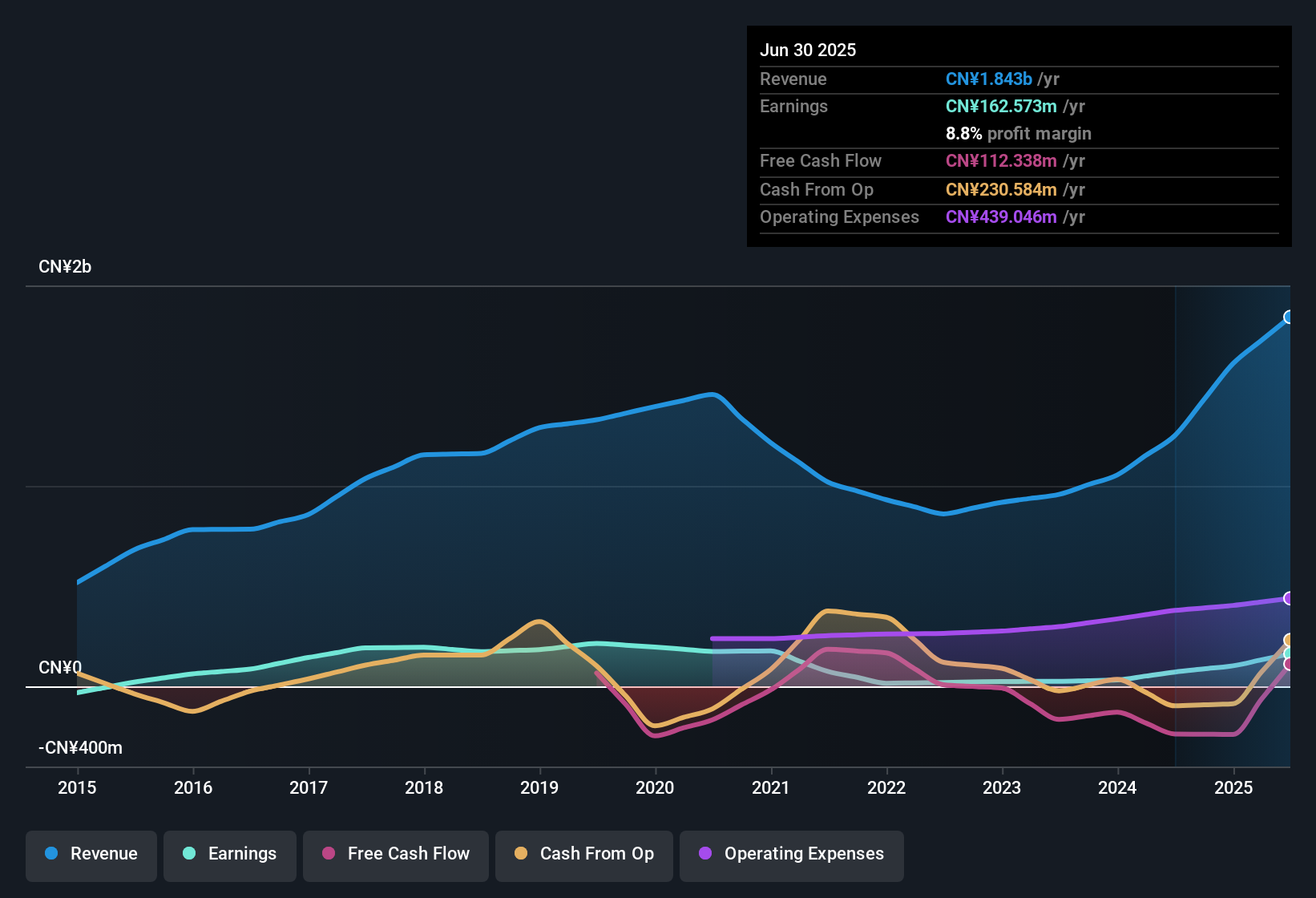

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Sun.King Technology Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 47% to CN¥1.8b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Check out our latest analysis for Sun.King Technology Group

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Sun.King Technology Group's balance sheet strength, before getting too excited.

Are Sun.King Technology Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Sun.King Technology Group insiders walking the walk, by spending CN¥4.9m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the Founder & Chairman of the Board, Jie Xiang, who made the biggest single acquisition, paying HK$2.0m for shares at about HK$1.02 each.

Along with the insider buying, another encouraging sign for Sun.King Technology Group is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth CN¥878m. Coming in at 26% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Is Sun.King Technology Group Worth Keeping An Eye On?

Sun.King Technology Group's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Sun.King Technology Group belongs near the top of your watchlist. Of course, just because Sun.King Technology Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sun.King Technology Group, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:580

Sun.King Technology Group

An investment holding company, manufactures and trades in power electronic components for use in power transmission and distribution, electrified transportation, industrial, and other sectors in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives