Slowing Rates Of Return At L.K. Technology Holdings (HKG:558) Leave Little Room For Excitement

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. That's why when we briefly looked at L.K. Technology Holdings' (HKG:558) ROCE trend, we were pretty happy with what we saw.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for L.K. Technology Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = HK$699m ÷ (HK$7.7b - HK$3.7b) (Based on the trailing twelve months to September 2022).

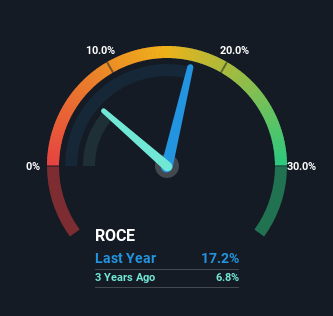

So, L.K. Technology Holdings has an ROCE of 17%. In absolute terms, that's a satisfactory return, but compared to the Machinery industry average of 7.0% it's much better.

See our latest analysis for L.K. Technology Holdings

Above you can see how the current ROCE for L.K. Technology Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for L.K. Technology Holdings.

SWOT Analysis for L.K. Technology Holdings

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Machinery market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow faster than the Hong Kong market.

- Debt is not well covered by operating cash flow.

What Can We Tell From L.K. Technology Holdings' ROCE Trend?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has employed 93% more capital in the last five years, and the returns on that capital have remained stable at 17%. Since 17% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 48% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously. Although because current liabilities are still 48%, some of that risk is still prevalent.

The Bottom Line

In the end, L.K. Technology Holdings has proven its ability to adequately reinvest capital at good rates of return. And long term investors would be thrilled with the 630% return they've received over the last five years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

One more thing to note, we've identified 1 warning sign with L.K. Technology Holdings and understanding it should be part of your investment process.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:558

L.K. Technology Holdings

An investment holding company, designs, manufactures, and sells machines, machining centres, and related accessories in Mainland China, Europe, North America, Central America, South America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success