L.K. Technology Holdings (HKG:558) Use Of Debt Could Be Considered Risky

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that L.K. Technology Holdings Limited (HKG:558) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for L.K. Technology Holdings

How Much Debt Does L.K. Technology Holdings Carry?

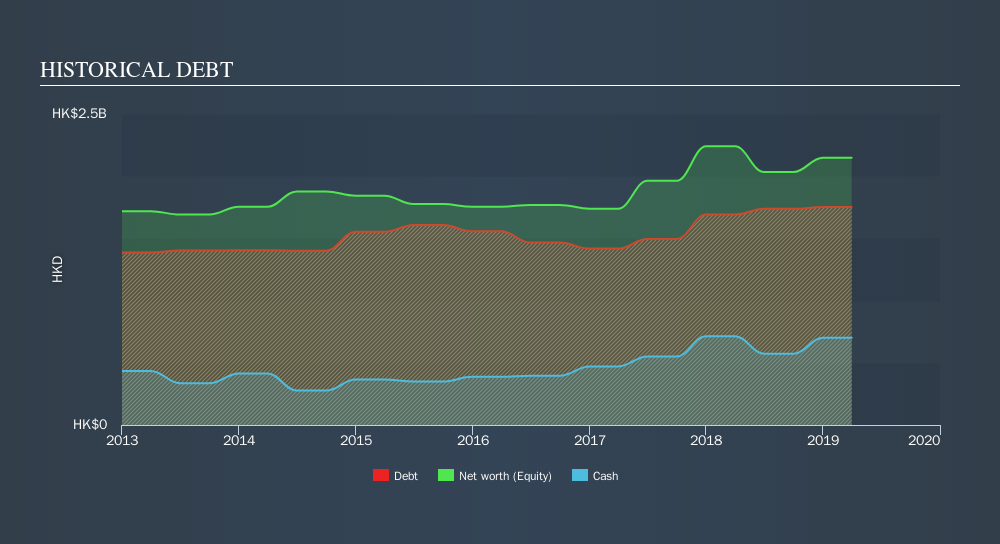

As you can see below, L.K. Technology Holdings had HK$1.75b of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had HK$700.6m in cash, and so its net debt is HK$1.05b.

A Look At L.K. Technology Holdings's Liabilities

We can see from the most recent balance sheet that L.K. Technology Holdings had liabilities of HK$2.61b falling due within a year, and liabilities of HK$466.4m due beyond that. On the other hand, it had cash of HK$700.6m and HK$1.33b worth of receivables due within a year. So its liabilities total HK$1.04b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the HK$595.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, L.K. Technology Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

L.K. Technology Holdings has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 3.4 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Another concern for investors might be that L.K. Technology Holdings's EBIT fell 15% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. There's no doubt that we learn most about debt from the balance sheet. But it is L.K. Technology Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, L.K. Technology Holdings's free cash flow amounted to 25% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, L.K. Technology Holdings's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. After considering the datapoints discussed, we think L.K. Technology Holdings has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check L.K. Technology Holdings's dividend history, without delay!

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:558

L.K. Technology Holdings

An investment holding company, engages in the design, manufacture, and sale of hot and cold chamber die-casting machines in Mainland China, Hong Kong, Europe, Central America and South America, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives