- China

- /

- Electronic Equipment and Components

- /

- SZSE:002658

Three Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape marked by fluctuating consumer confidence and shifting indices, investors are increasingly focused on finding stable income sources amidst uncertainty. Dividend stocks offer an attractive proposition in such environments, providing consistent returns that can help balance portfolios against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

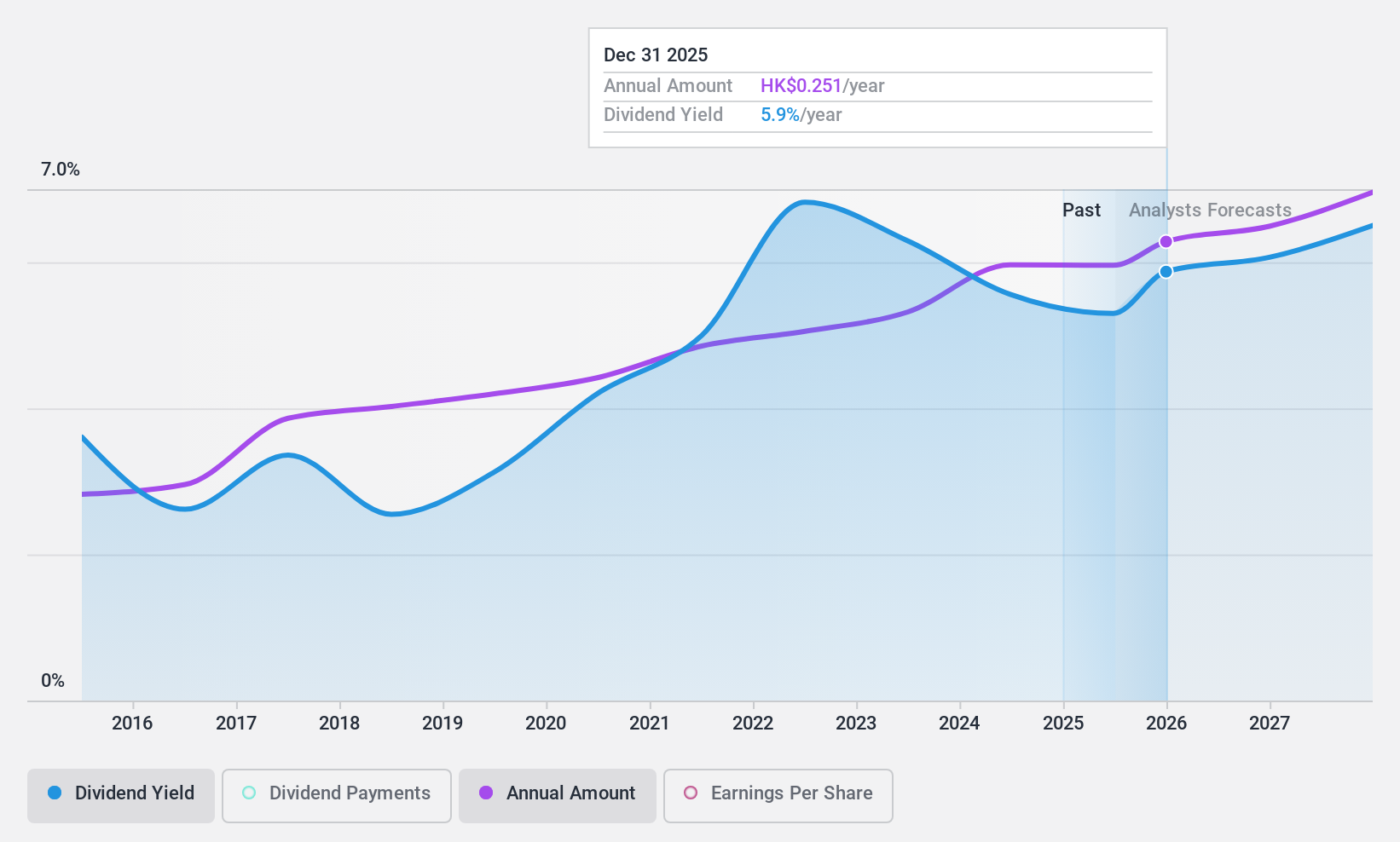

China Communications Services (SEHK:552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Communications Services Corporation Limited provides telecommunications support services worldwide and has a market cap of HK$31.58 billion.

Operations: China Communications Services Corporation Limited generates revenue primarily through the Provision of Integrated Comprehensive Solutions, amounting to CN¥149.86 billion.

Dividend Yield: 5%

China Communications Services offers a mixed dividend profile, with dividends well-covered by both earnings and cash flows, maintaining payout ratios of 41% and 49.5%, respectively. Despite this coverage, the company has experienced volatile dividend payments over the past decade, making them unreliable for consistent income seekers. Recent management changes include new appointments at executive levels but are unlikely to immediately impact dividend stability or growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of China Communications Services.

- In light of our recent valuation report, it seems possible that China Communications Services is trading behind its estimated value.

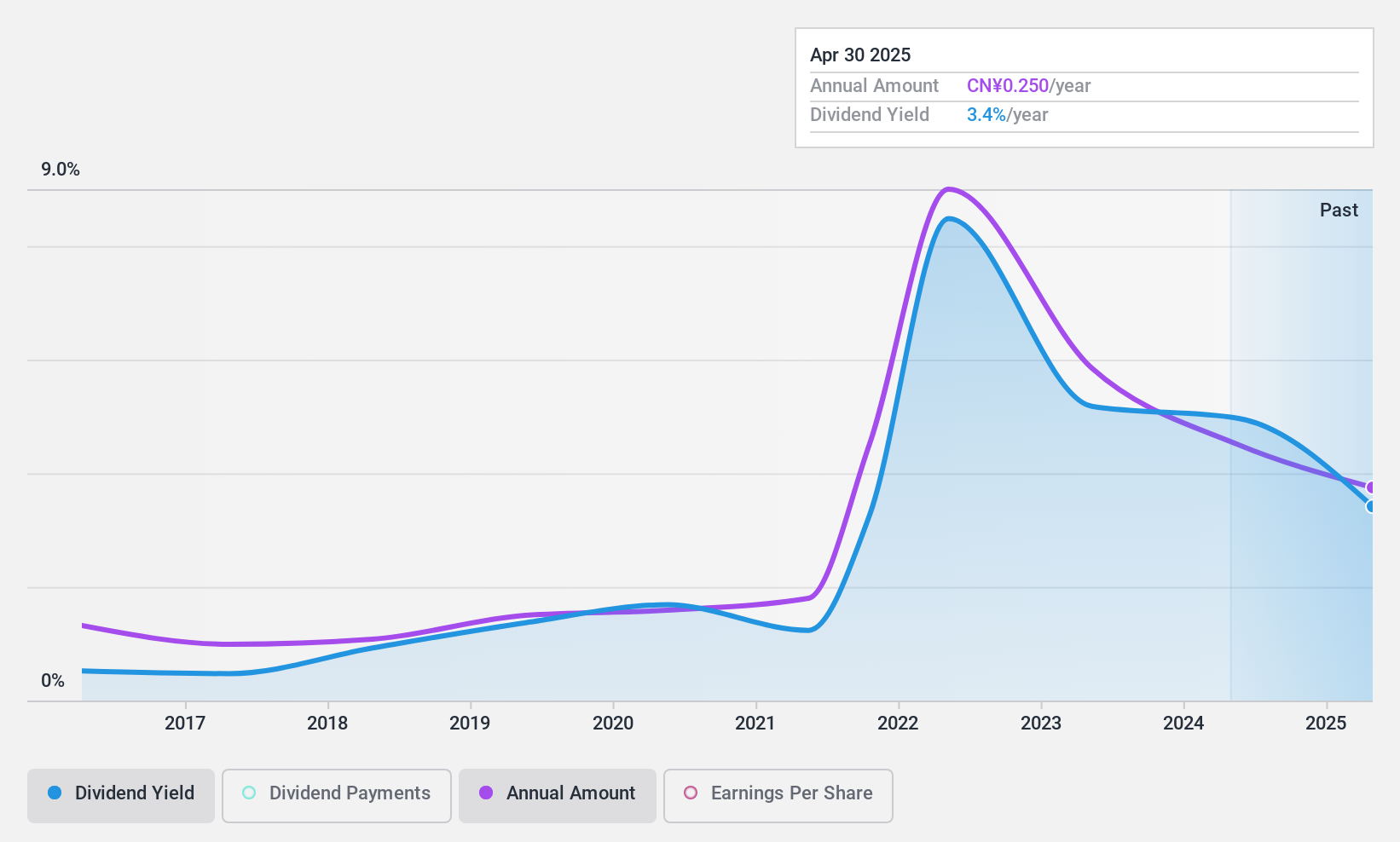

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing SDL Technology Co., Ltd. and its subsidiaries develop and sell environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥4.12 billion.

Operations: Beijing SDL Technology Co., Ltd. generates revenue through its environmental monitoring equipment and solutions offered domestically and globally.

Dividend Yield: 4.5%

Beijing SDL Technology's dividend profile is challenging, with a high payout ratio of 119.9% indicating dividends are not well covered by earnings, though cash flows provide some coverage at 58.4%. Despite being among the top dividend payers in China with a yield of 4.55%, dividends have been volatile and unreliable over the past decade. Recent financials show declining sales and net income, raising concerns about future dividend sustainability following its removal from the S&P Global BMI Index.

- Dive into the specifics of Beijing SDL TechnologyLtd here with our thorough dividend report.

- Our valuation report here indicates Beijing SDL TechnologyLtd may be undervalued.

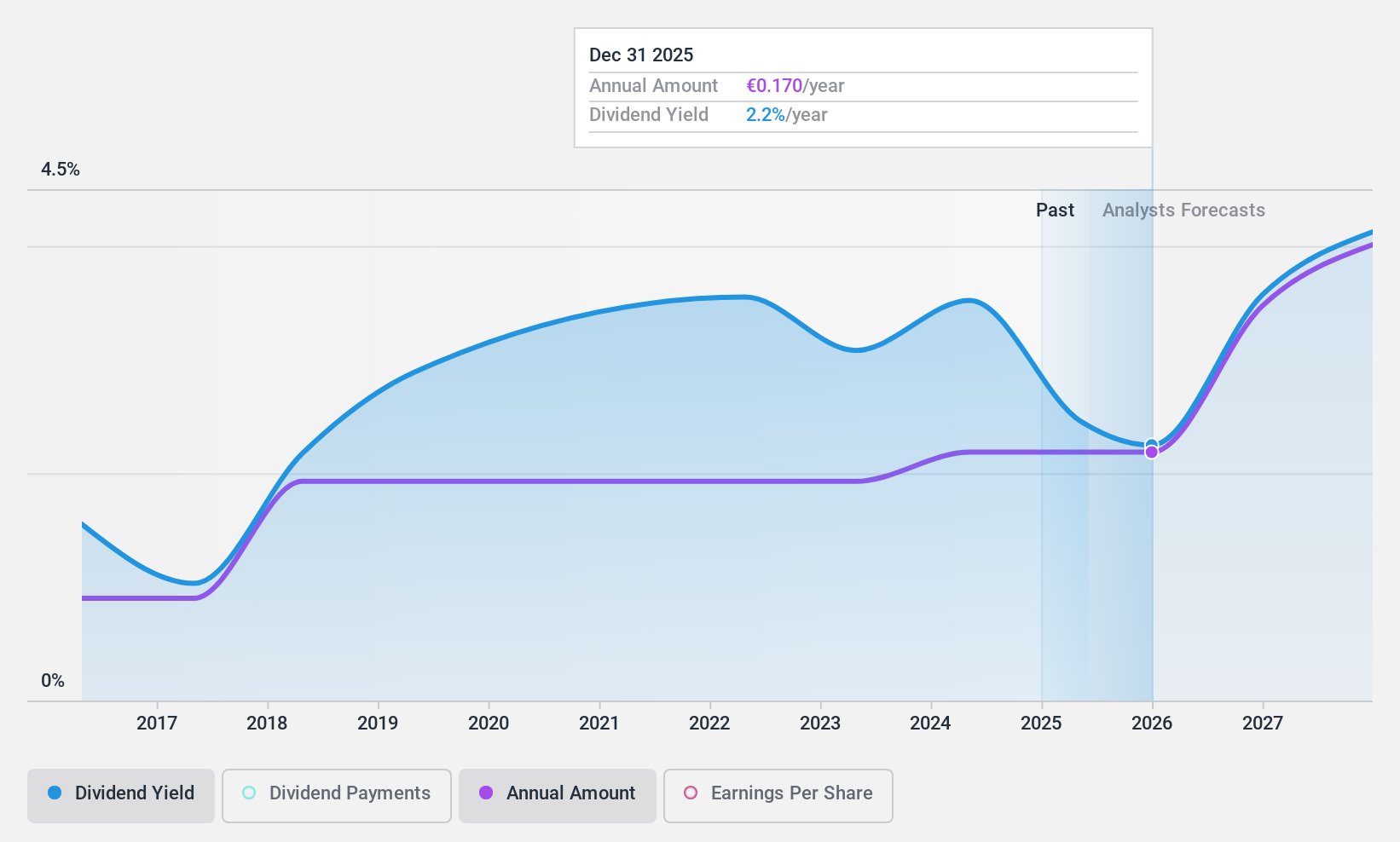

DEUTZ (XTRA:DEZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of €560.32 million.

Operations: DEUTZ's revenue is primarily derived from its Classic segment, generating €1.85 billion, with an additional contribution of €7 million from the Green segment.

Dividend Yield: 4.2%

DEUTZ's dividend sustainability is supported by a low payout ratio of 44.3% and a cash payout ratio of 53.7%, indicating coverage by both earnings and cash flows. However, the company's dividends have been volatile over the past decade, with significant fluctuations in payments. Recent financials show decreased sales (€1.31 billion) and net income (€33.8 million), raising concerns about future stability despite trading at good value relative to peers and industry estimates.

- Click to explore a detailed breakdown of our findings in DEUTZ's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of DEUTZ shares in the market.

Make It Happen

- Click here to access our complete index of 1949 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SDL TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002658

Beijing SDL TechnologyLtd

Develops and sells environmental monitoring equipment and solutions in China and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives