- Hong Kong

- /

- Trade Distributors

- /

- SEHK:521

With EPS Growth And More, CWT International (HKG:521) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CWT International (HKG:521). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CWT International with the means to add long-term value to shareholders.

How Quickly Is CWT International Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. CWT International managed to grow EPS by 13% per year, over three years. That's a pretty good rate, if the company can sustain it.

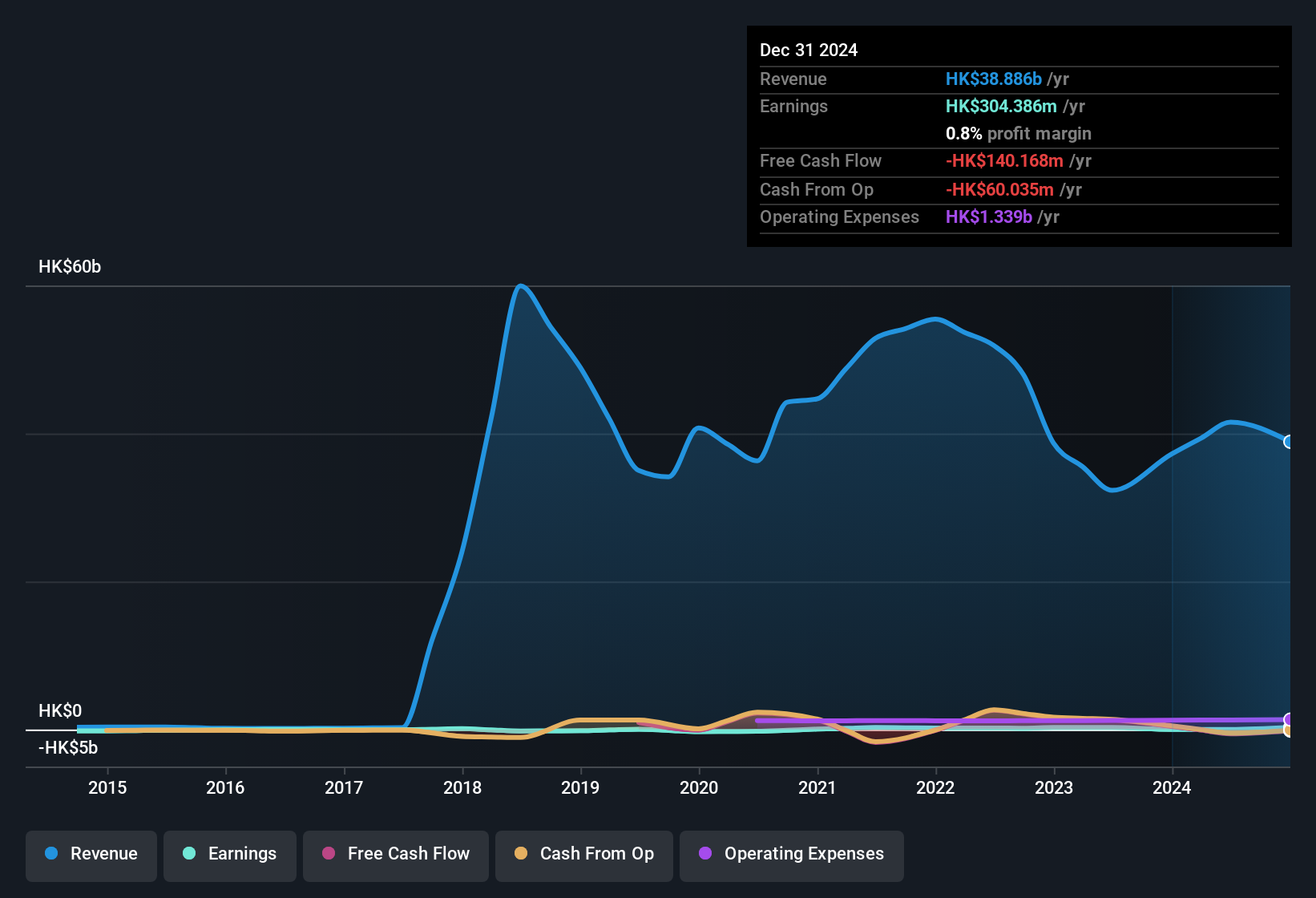

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, CWT International has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Check out our latest analysis for CWT International

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check CWT International's balance sheet strength, before getting too excited.

Are CWT International Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to CWT International, with market caps between HK$1.6b and HK$6.2b, is around HK$3.0m.

CWT International's CEO took home a total compensation package of HK$889k in the year prior to December 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does CWT International Deserve A Spot On Your Watchlist?

One important encouraging feature of CWT International is that it is growing profits. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So based on its merits, the stock deserves further research, if not an addition to your watchlist. Before you take the next step you should know about the 1 warning sign for CWT International that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:521

CWT International

An investment holding company, provides logistics, commodity marketing, engineering, and financial services in Mainland China, rest of the Asia Pacific Region, the United States, Europe, and Africa.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives